Bitcoin futures recorded a new record high, coinciding with the price of the currency surpassing $72,700, according to data monitored by specialized platforms. While waiting for US inflation data to be released tomorrow, Wednesday, which could cause fluctuations in the market. is broken down Bitcoin Price The upper border of the ascending triangle technical pattern, indicating that the bulls are in control of the market at this time.

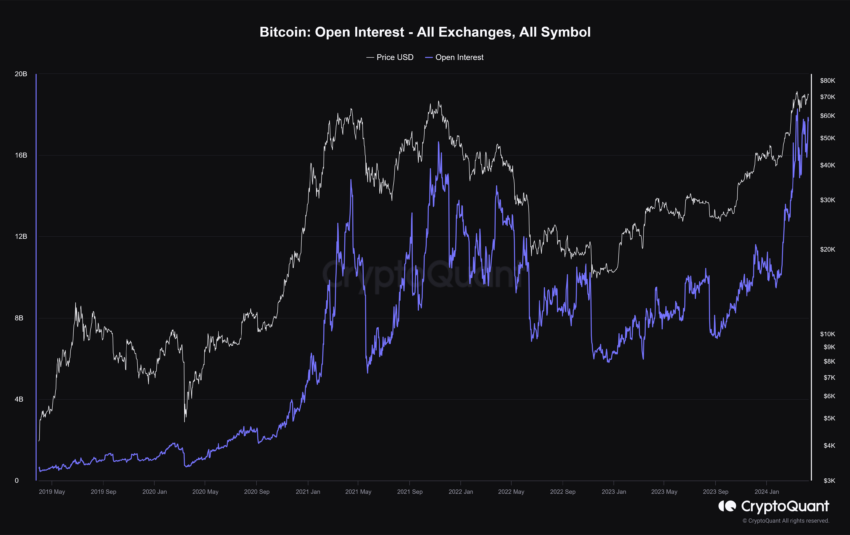

indicate Data The CryptoQuant platform reported that the volume of open Bitcoin futures recently reached an all-time high.

As the chart above shows, open positions on Bitcoin have been recorded BTC There has been a big increase recently, reaching a new record of almost $18.2 billion. This increase occurred with the rise in the price of cryptocurrency.

This correlation between the rise in the price of Bitcoin and that of futures contracts is unusual, as price increases generate significant interest and open the door to new waves of speculation in the derivatives market.

What does high volume of open Bitcoin futures mean?

The Open Interest indicator measures the total value of Bitcoin futures contracts currently open on all cryptocurrency exchanges.

“High open interest” in the cryptocurrency market refers to the total number of active contracts. Whether purchase or sale contracts that have not yet been concluded or settled on the digital currency market.

Read also: What is futures trading? What is the difference between this trading and margin trading?

When the amount of open interest increases, it indicates that more money is entering the market and that there is increased interest in the asset in question, in this case Bitcoin.

Here are some potential effects of high volume of open interest on the price of Bitcoin:

- Increase liquidity: High open interest generally means there is more liquidity in the market. This makes it easier for traders to execute their trades without significantly impacting the price.

- Volatility: Increased open interest may result in increased price volatility. More and more traders are likely to react to influential news or events.

- Bullish or bearish indicators: Sometimes a rise in open interest can be interpreted as a bullish indicator. This means that more and more investors are expecting the price of Bitcoin to rise. It can also be interpreted as a bearish indicator if viewed as preparation for a potential sell-off.

- Institutional interest indicator: Higher open interest may also reflect increased interest from institutional investors. Who can consider Bitcoin as a long-term investment or as part of complex hedging strategies.

It is important to understand that the volume of open interest alone cannot be a sufficient indicator for making investment decisions. It should be considered in conjunction with other factors such as trading volume, fundamental news, technical analysis, and market sentiment to get a clearer picture of potential cryptocurrency market trends.

Negative indicators and warnings

High Futures Levels Indicate Possibility of Increased Volatility BitcoinBTCThis volatility can evolve upwards or downwards. However, the historically observed correlation between rising futures and periods of Bitcoin price peaks worries some observers.

For example, synchronization Previous standard level For futures, the price of Bitcoin exceeded $73,000. This was followed by a rapid decline in the price of the cryptocurrency.

It is true that it is not certain that the same scenario will repeat itself this time, but the continuation of these high levels of futures contracts likely portends increased volatility in the price of Bitcoin in the period to come.

Consequences of the rise and liquidation of transactions

Increased volatility typically leads to mass liquidations – that is, the forced closing of losing trades to cover losses – and this liquidation in turn contributes to increased volatility. For example, when the price falls, short sale trades (bets on the decline) are liquidated to cover losses. Which leads to a further drop in price, and so on in a vicious circle.

The current upswing has already been marked by a massive liquidation of short-selling trades in the digital currency market, with losses exceeding $108 million, according to the report. Data CoinGlass Platform.

Observation :

It is difficult to predict the evolution of a volatile cryptocurrency like Bitcoin, so all scenarios remain possible, and the only certainty is that investors expect potential volatility in the short term.

Technical analysis of the Bitcoin price

Bitcoin BTC Price It exceeded the upper limit of the symmetrical triangle pattern we mentioned in the previous analysis, but it did not reach the high of 73,300 as we had expected. Instead, it stalled around the 72,700 level, before rebounding to the current $71,000 level.

Probably come back BTC Price Test the broken upper limit before continuing higher. If it goes back below the level of the upper border of the triangle, it means that this pattern has failed and should be removed from the chart. The ascending trendline currently remains the strongest support level.

In general, we could see calm exchanges until the data is released. Consumer Price Index CPI In the United States of America tomorrow Wednesday.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,تحليلات,تحليلات تقنية,العملات الرقمية,بيتكوين,سعر بيتكوين

Comments

Post a Comment