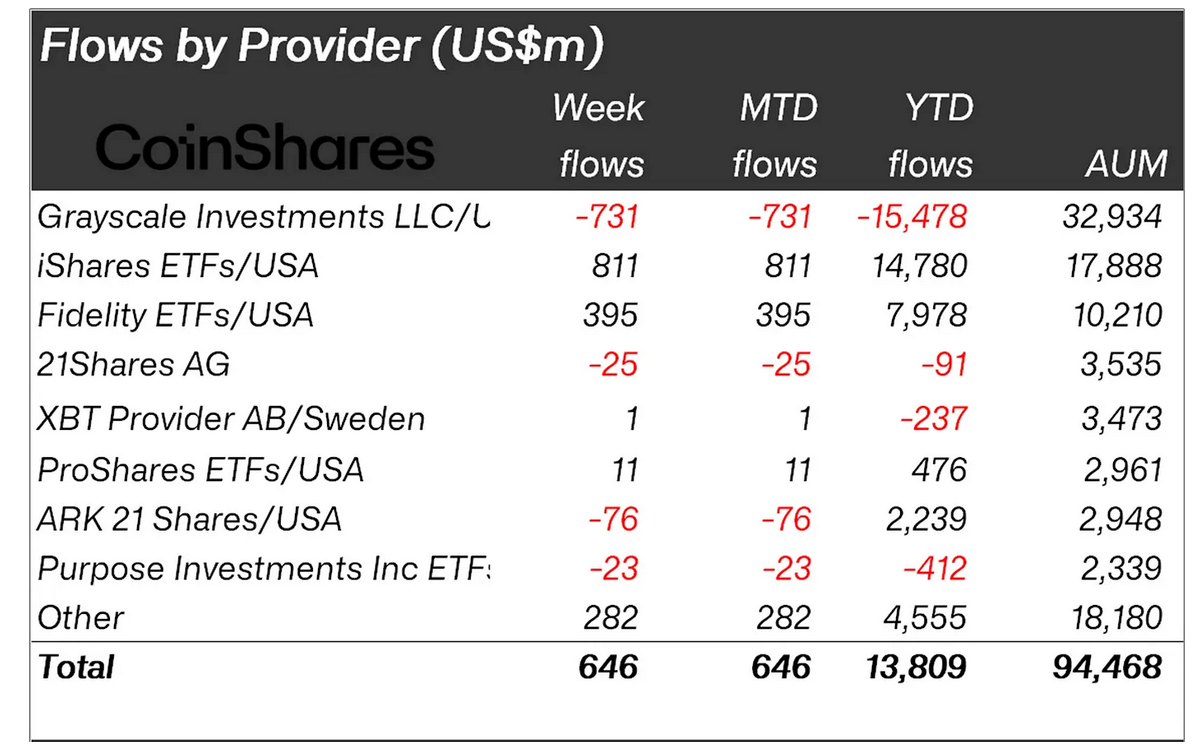

Global cryptocurrency funds have seen a record level of annual financial flows, reaching nearly $13.8 billion since the start of the year. According to Report Issued by the asset management company Coinshares. This achievement represents a significant increase in investor participation in the cryptocurrency market. It highlights the growing trust and interest in digital assets as a viable investment vehicle.

The latest flow figures also reveal an additional injection of $646 million into cryptocurrency funds globally over the past week, adding to the momentum of this trend.

Strong appetite for cryptocurrency investment products

The increase in financial flows is attributed to the growing appetite of investors for cryptocurrency investment products. Offered by leading asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares. These investment vehicles have seen significant inflows, with investors allocating huge amounts of capital to gain exposure to various cryptocurrencies.

Of particular interest is the growing demand for Bitcoin investment products, such as spot Bitcoin ETFs. These funds remain the priority of many investors looking to invest in the leading cryptocurrency.

Read also: Have Bitcoin ETFs weakened upside potential after the “halving”?

James Butterville, head of research at CoinShares, noted: down Spot Bitcoin ETF entry levels have increased compared to early March, indicating a possible stabilization of investor appetite.

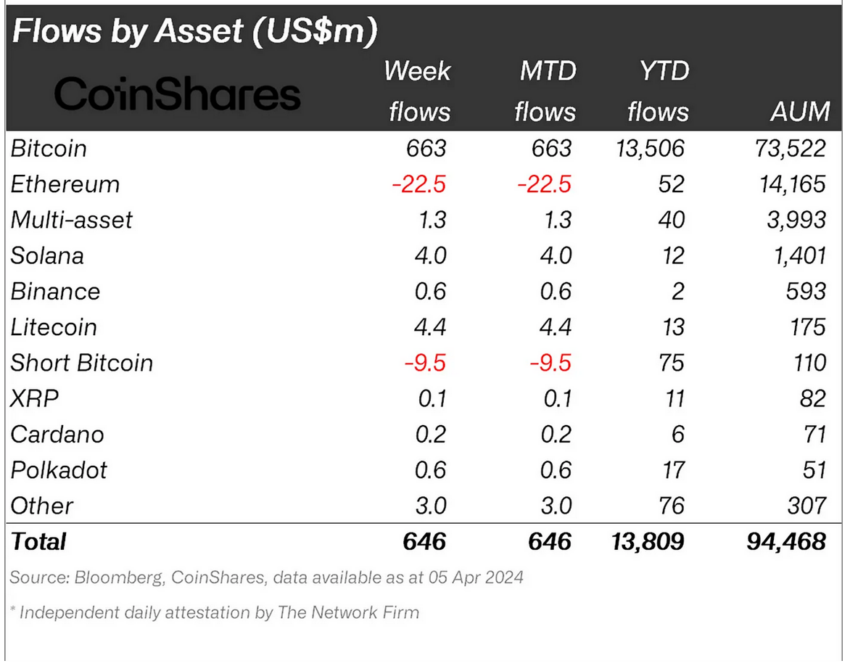

However, capital flows into global Bitcoin investment products remained strong. Nearly $663 million was added to these methods last week alone.

This highlights Bitcoin's enduring appeal as a store of value and investment asset that appeals to both institutional and retail investors.

Diversification and regional trends

As Bitcoin continues to dominate the cryptocurrency investment landscape, other digital assets have attracted considerable interest from investors.

Investment products that track cryptocurrencies such as Litecoin, Solana, and Filecoin have seen notable inflows. This reflects a broader trend toward diversification within the digital currency investment space.

In return, I faced Funds that invest in Ethereum Releases for the fourth consecutive week. Which indicates a difference in investor sentiment towards different digital currencies.

At the regional level, opinions remain divided; US-based funds are seeing significant inflows as are products in Brazil, Hong Kong and Germany.

In contrast, Switzerland and Canada experienced capital outflows, highlighting varying levels of investor confidence and market dynamics across regions.

Financial institutions adopting cryptocurrencies

In another sign of institutional adoption, major financial institutions such as BlackRock and Morgan Stanley are expanding their presence in the cryptocurrency investment space.

BlackRock, for example, recently decided to add five new participants to its iShares Bitcoin Trust (IBIT) ETF. This reflects the growing demand for digital currency investment products among traditional financial institutions.

Similarly, Morgan Stanley plans to approve Bitcoin ETFs on its platform within the next week. Which indicates remarkable success in integrating digital currencies into traditional investment channels.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,العملات الرقمية,العملات المشفرة,صناديق ETF,صناديق الاستثمار

Comments

Post a Comment