settle Bitcoin (BTC) Price) is near the $70,000 level, where bulls are looking for another breakout next week.

Blockchain transaction data indicates that recent statements by US Federal Reserve Chairman Jerome Powell sparked an immediate positive reaction among Bitcoin traders.

Bitcoin Rise Bets Volume Increases After Federal Reserve Chairman’s Statement

reach Bitcoin BTC Price It peaked at 70,763 during intraday trading on March 31, on track to end the month with a 17% gain.

antiques a licence US Federal Reserve Chairman Jerome Powell expressed optimism among Bitcoin traders. After telling journalists on Friday March 29 that there was “no reason to believe” that the risks of a recession in the United States were high.

“There is no reason to believe that the economy is in recession or on the verge of a recession,” Mr. Powell said. “We consider the economy to be strong and the job market to be in good shape.”

Almost immediately, Bitcoin traders reacted positively to Jerome Powell's optimistic comment.

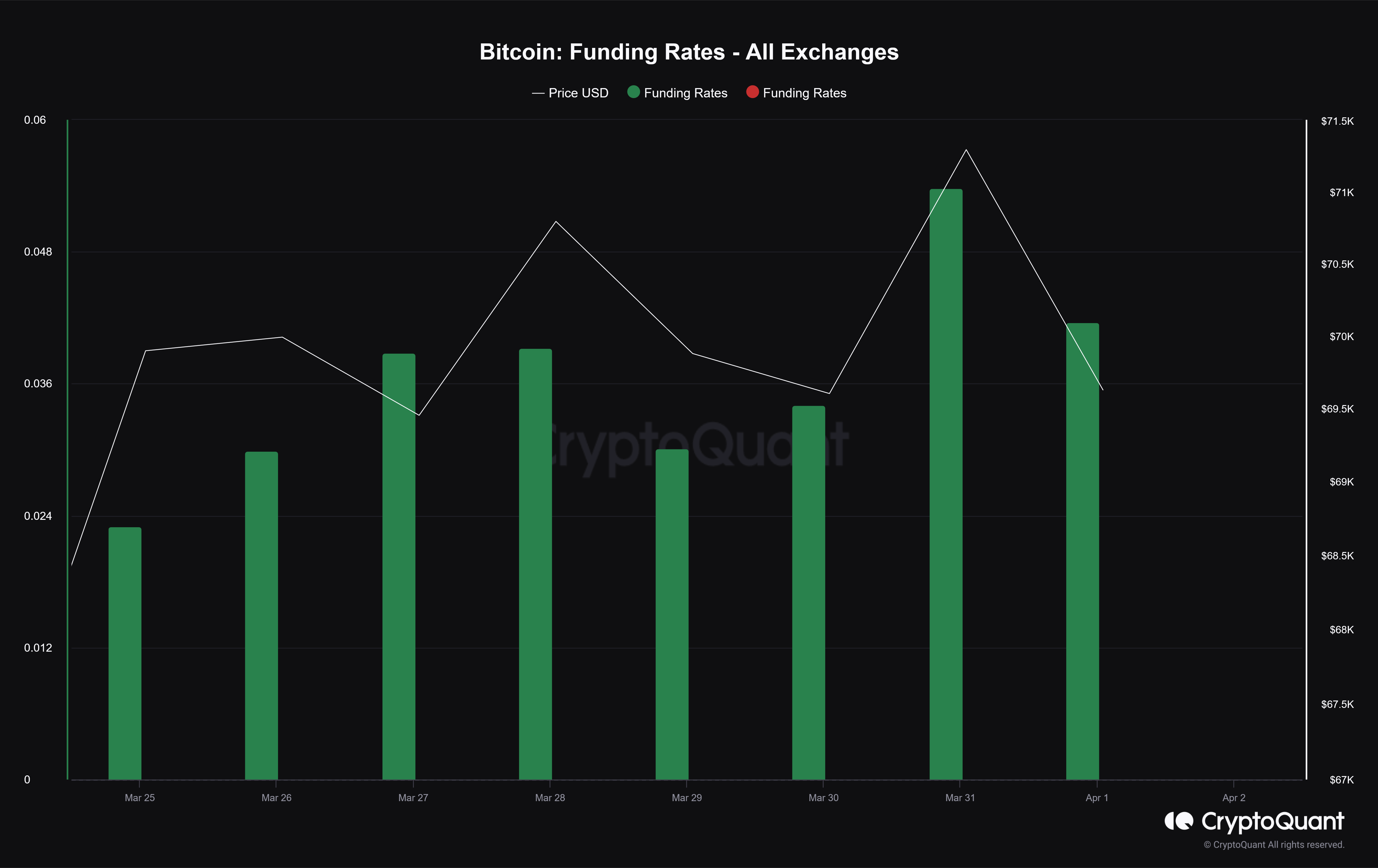

In the 48 hours following Powell's comments, Bitcoin (LONG) bullish activity increased. Bitcoin's funding rate increased 100%, from 0.03% on March 29 to 0.06% at the time of writing on March 31, according to Data CryptoQuant Platform.

The funding rate, or “funding rate,” in the cryptocurrency market is a concept used primarily in perpetual futures trading and represents the fees traders pay themselves to keep their positions open.

Basically, the funding rate ensures a balance between long and short positions open in the market. If there are more buyers than sellers, the financing rate is positive, and vice versa.

This mechanism ensures balance and maintains the correlation of futures prices with spot market prices.

The increase in the positive funding rate means that long (LONG) traders now pay higher fees to short (SHORT) holders to keep their contracts open.

This occurs when long position traders are confident of an imminent price rise, meaning they make large profits, as evidenced by their preference for greater leverage.

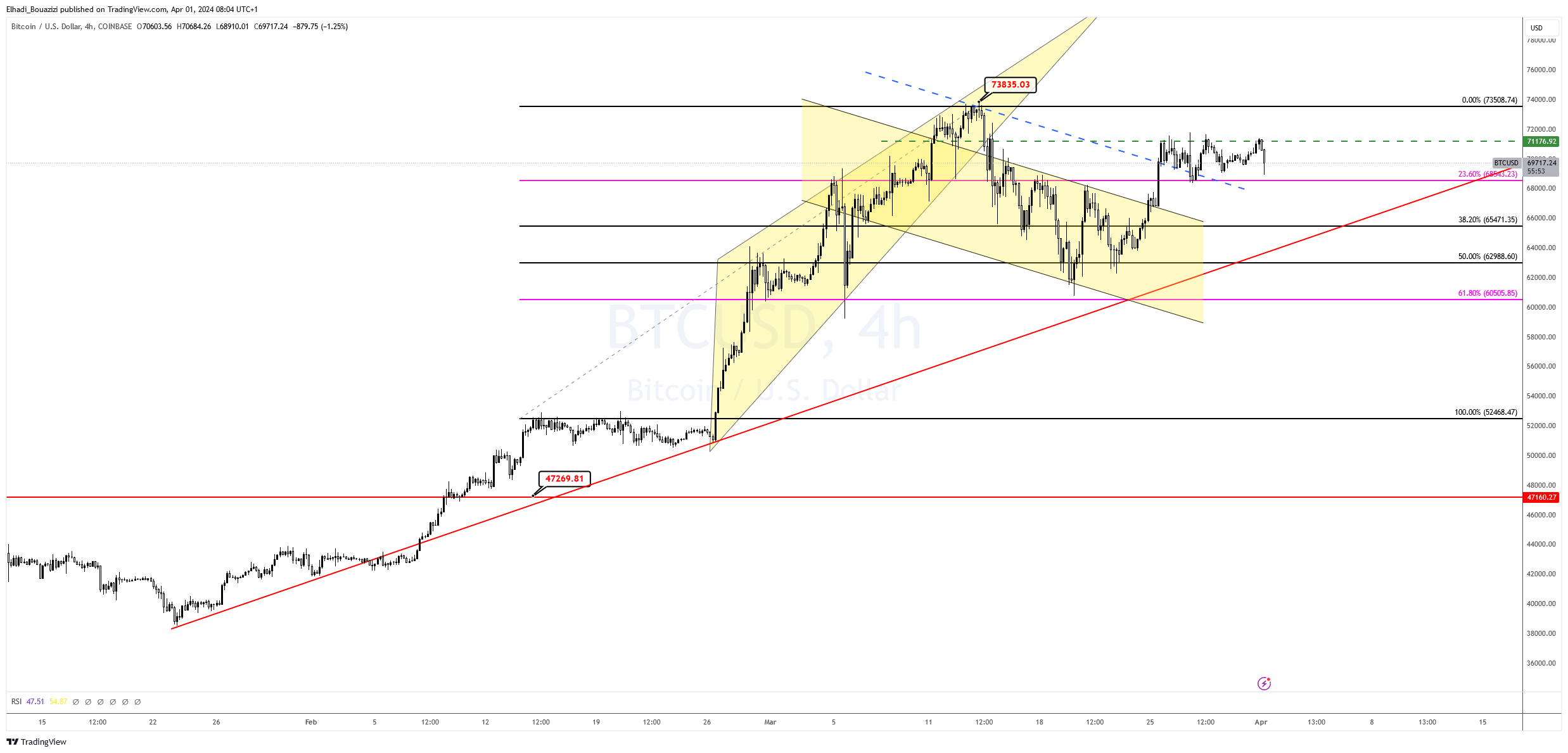

Technical Analysis: Bitcoin BTC Price Maintains Sideways Trading

Over the past three weeks it has been Bitcoin BTC Price He evolves precisely in the technical levels and respects them deeply. Therefore, I believe the chart can give us a clear indication of the interaction of supply and demand forces in the market.

Currently, the price is moving sideways, indicating a growing state of equilibrium in the market between the bulls and the bears.

And we expected Our previous analyzes This will happen, even if the movement space is much narrower than imagined. Throughout the past week, Bitcoin price was rangebound between the 23.6% Fibonacci level at $68,500 and the resistance level at $71,175.

Now, on the 4-hour chart, we notice the formation of the triple top reversal pattern. If the price breaks above $68,500, we will see a decline towards the 50% Fibonacci support level at $65,500.

There is also an upward trendline, making it a strong support zone. If broken, the next target will be the 61.8% Fibonacci level at $60,500.

As for the bullish possibilities, of course, the all-time high of $73,800 must be breached by closing the daily candle above it.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,تحليلات تقنية,البيتكوين,العملات الرقمية,بيتكوين

Comments

Post a Comment