Increased Ethereum (ETH) currency price) sharply early in the morning of the East Asian trading day Tuesday. This good performance is due to several factors, the most important of which is the rise of the new decentralized finance protocol, Ethena. And not because of the issue of approval of Ethereum Instant ETFs, which have controlled trading over the past few weeks.

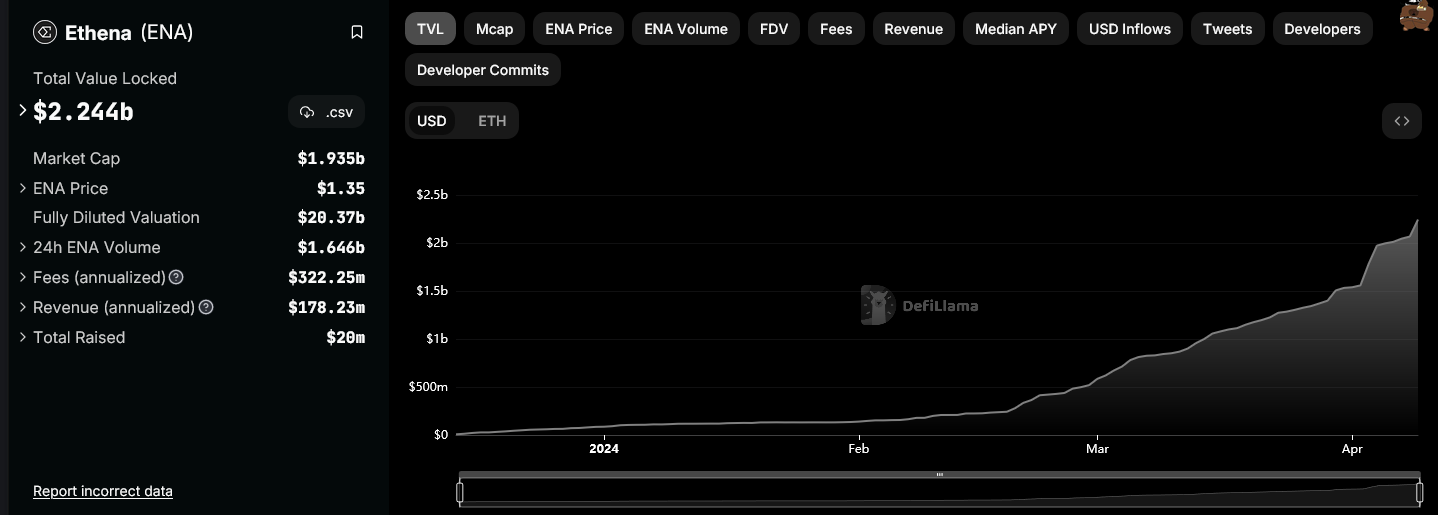

And she emphasizes Data defillama platform which Total Value LockedTVL ENA's own coin, the DeFi Ethena protocol, crossed the $2.2 billion mark over the past few days after surpassing $2 billion on April 6.

Ethena is a protocol built on the Ethereum blockchain that offers a stablecoin called USDe, commonly referred to as “Internet Bond”.

Ethena aims to create a native cryptocurrency stablecoin independent of the structure of the traditional banking system, making it globally available and scalable while remaining censorship resistant.

The protocol includes a neutral strategy called delta-neutral strategy which uses ETH and ETH derivatives to keep the value of USDe stable. This system is characterized by offering users high annual rates of return by investing and betting on Ethereum futures contracts.

Ethena experienced rapid growth, with the market capitalization of its stablecoin USDe reaching remarkable levels immediately after its launch.

In addition, Ethena includes a governance aspect through... Its own digital currency, ENA, which allows users to participate in protocol decisions. The rapid growth of the protocol and its innovative financial mechanisms have allowed it to attract the attention of many players in the decentralized finance (DeFi) sector.

Ethena's USDe stablecoin recently added Bitcoin as collateral, according to media reports.

Popularity on social media platforms and the future

According to For data from the LunarCrush platform Specialized in social data analysis. “Social activity continues to accelerate, accompanied by strong price movements and increased transaction volumes,” the company noted.

Additionally, Ethereum derivatives markets reflect potential bullish sentiment for the remainder of the current month. Alright then For the data Walk DeributeOpen trading volume at the $4,000 level is around $600 million, compared to $378 million at the $3,700 and $5,000 levels.

Which indicates an upward trend and optimism among investors with the monthly options contracts expiring on April 26, when approximately 900,000 Ethereum contracts with a theoretical value of $3.8 billion will expire.

Reservations and Warnings Regarding Rejection of Ethereum ETFs

Despite these positive signs, some analysts express reservations about the strength and sustainability of this increase. They pointed out that hopes for approval of Ethereum ETFs are the main driver, and that this momentum could be short-lived if regulators reject these funds.

And he sees Bettors on Polymarket There is a 23% chance that Ethereum spot ETFs will be approved in the US by the end of May and only a 45% chance of being approved by the end of June.

Some traders expected Bitcoin dominance after the Ethereum/Bitcoin ratio fell below a key support level last week. As a result, Ethereum's rally led to a rapid adjustment of market positions, resulting in a sharp rise in perpetual funding rates or the cost of holding long/short positions, QCP Capital explained.

“Last Friday, we were forecasting a potential rally and expected Bitcoin to lead the move,” QCP wrote. “We were wrong about the leader, as the movement has largely been led by Ethereum.”

Technical analysis of the price of Ethereum (ETH).

On the 4h chart we notice that... Ethereum (ETH) price. It broke above the resistance level at $3,650, where there is a 23.6% Fibonacci retracement and a group of previous highs that indicate the strength of this resistance.

But at the time of writing, we notice that the price has returned below this level, which means that this may be a false breakout.

In any case, the daily candle close should be monitored for confirmation. This will open the door for a further rise to the $4,000 level.

Failure to breakout means bounce and fall ETH Price Toward the $3300 level, then $3100 at the 38.2 and 50% Fibonacci levels, respectively.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,تحليلات تقنية,إيثيريوم,إيثيريوم ETH,العملات الرقمية

Comments

Post a Comment