Platform-specific digital currency Solana SOL piece A significant drop of 21% over the past week, reaching its lowest levels in six weeks. This drop resulted in the liquidation of $113 million of SOL futures into highly leveraged long positions, indicating excessive optimism from investors following the 61% surge in SOL price in March.

The risks of correction... and the growth of the Solana system

This drop raises questions about the possibility of further corrections For the SOL currencyWill the $130 support level hold?

Despite the price drop, analysts believe Solana's market value of $60 billion has been grossly inflated compared to similar decentralized platforms such as Avalanche ($13 billion) and Tron ($10 billion).

Some, however, justify this difference by the rapid expansion of the Solana ecosystem by launching numerous projects of their own digital currencies.

In an approach likely to help strengthen investor confidence, She declared On April 16, exchange Coinbase integrated its wallet with decentralized trading platforms on Solana, supporting more than 50,000 digital currencies on the network.

Declining Interest in the Futures Market and Funding Volatility

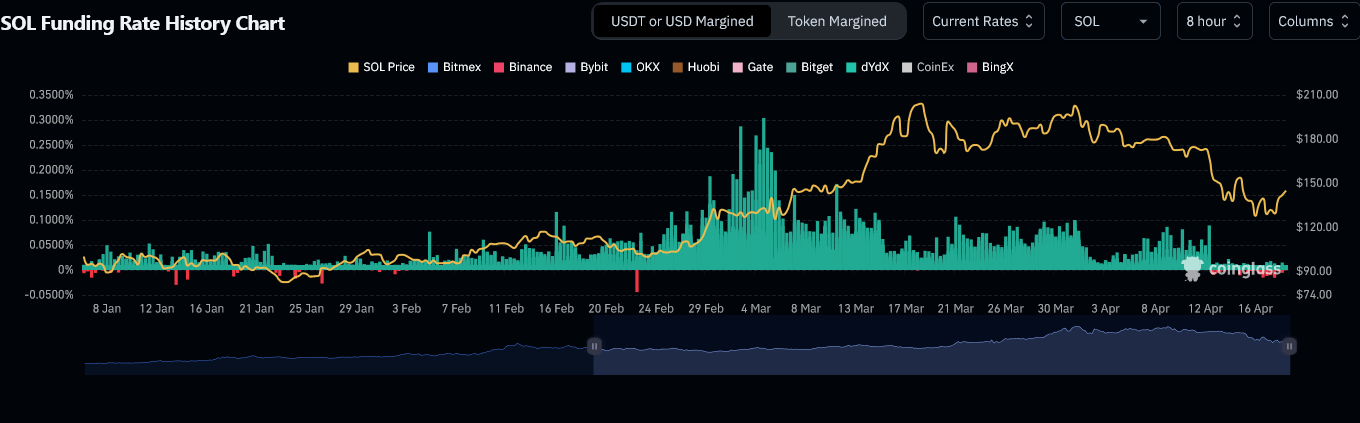

The value of open positions on futures contracts has decreased For the currency SOL rose 40% between April 12 and 17, to $1.5 billion, reflecting a decline in demand for leveraged positions.

And he emphasizes Solana Futures Funding Rate This decline may be due to a lack of interest in purchasing positions.

This funding rate is a leading indicator of market trends; A positive rate indicates greater demand for long positions, while a negative rate indicates a preference for short positions in anticipation of falling prices.

Since April 12, the financing rate has remained... For the currency SOL Balanced, indicating equal interest between buy and sell positions.

Network congestion and decentralized application transactions

The Solana network has recently experienced severe congestion with a transaction failure rate of up to 75%. The developers responded by rolling out an update aimed at fixing these bottlenecks. Several major projects, like “Margin Fi,” also experienced setbacks that helped put pressure on... SOL currency price.

Despite these factors, and on a broader level, the Solana network has maintained significant activity in the area of decentralized applications. According to the DabRadar platform, the trading volume of decentralized applications on Solana increased by 60% over the past week. Despite the increase in activity, the number of active users on the network has stabilized at around 2 million users. There are not enough indicators indicating a decline. FLOOR piece Regarding the general altcoin market, continued network congestion may call into question the stability of its valuation compared to competing cryptocurrencies.

Technical Analysis of Solana SOL Price and Trading Opportunities

On the daily chart, it is clear that Price of Solana SOL It is moving in a strong upward trend.

Price is now testing this line at the $125-$130 support zone, which includes the 38.2% Fibonacci retracement level and a previous price peak.

So far, it seems many traders are using this as a buying zone. We mentioned this in a previous analysis. Since March 24, the price has tested this support zone several times, and each time the price rises sharply.

However, problems that emerged in the network as well as the general market decline led by Bitcoin stopped its sharp rise. All these factors prevent the price from increasing. With a clear downward trend in the short term.

The market is now generally in a state of anticipation and hence we might see some sideways or bearish trading in the market. And especially for For the Solana SOL piece This was recorded Pointed tips And an increase of more than 1000% since the beginning of last October.

However, the long-term outlook remains positive, and any declines towards lower support levels could represent investment or trading opportunities.

Of course, with a difference in time and objectives.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,تحليلات تقنية,تقرير إخباري,العملات الرقمية,سولانا,عملة سولانا

Comments

Post a Comment