Faces Digital Currency Market Alternative markets came under increasing selling pressure, amid fears of continued US monetary policy tightening and its negative impact on high-risk assets, prompting spot Bitcoin ETFs to record gains. cash outflows worth $162 million per day before the Federal Open Market Committee (FOMC) meeting. ) meeting.

I witnessed Bitcoin Prices TAcute recurrences Over the past 24 hours, it has been trading below the $57,000 level, while altcoins suffered larger losses.

Investors await the latest U.S. inflation data, which could raise the possibility of continued monetary tightening from the Federal Reserve, eliminating any possibility of interest rate cuts in the current year .

Declining social interest in alternative digital currencies

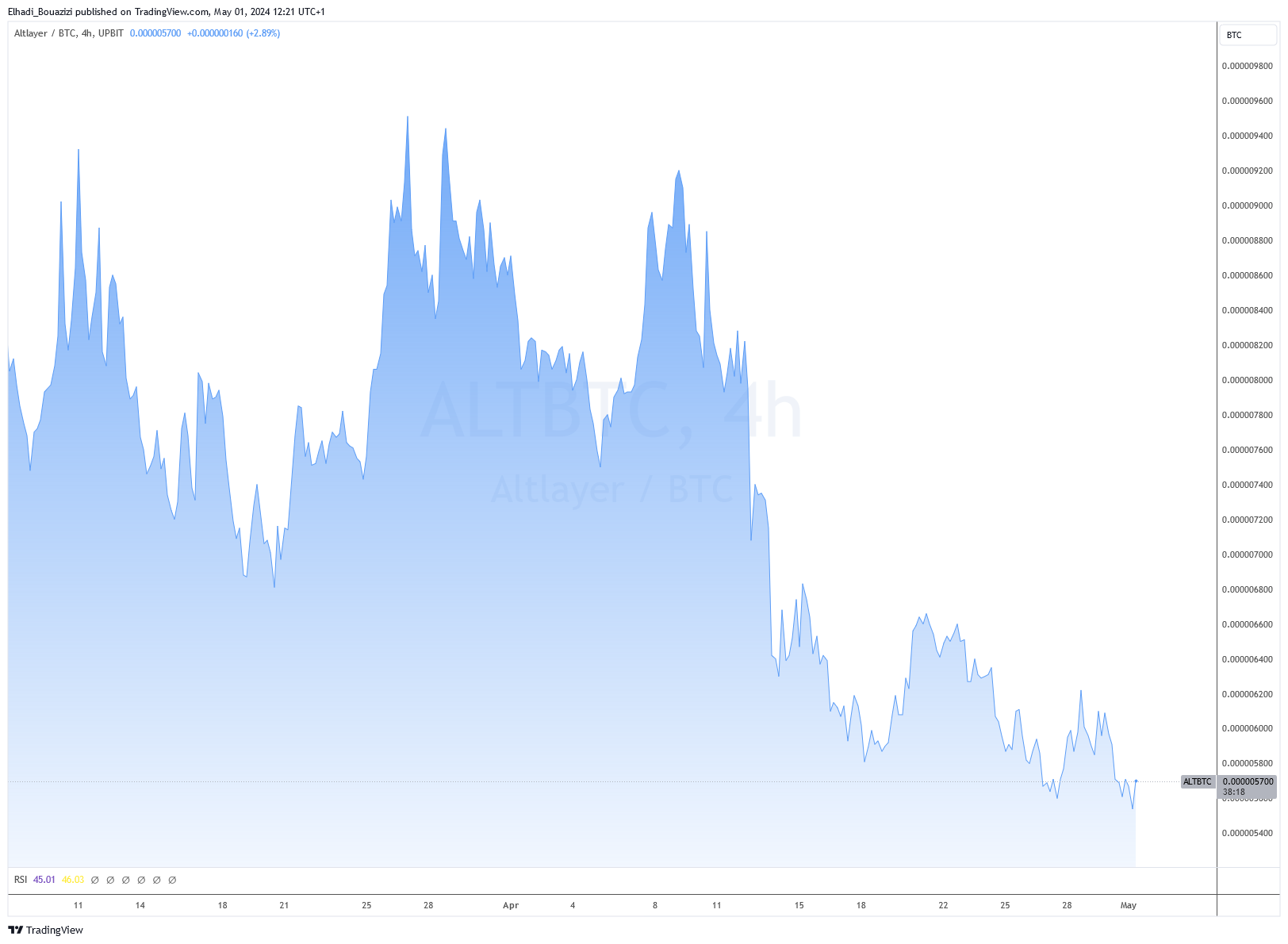

being seen Cryptocurrency analyst, Benjamin Cowen. Possible link between Altcoins/Bitcoin (ALT/BTC) Trading Ratios And an imminent drop in interest rates.

Highlighting similarities to the previous cycle, where declines in the index (ALT/BTC) preceded interest rate cut decisions. This led him to expect a further decline of up to 40% in the index (ALT/BTC) in the coming months.

Despite some short-term headwinds, Cowan maintains his expectations. In light of the suffering of alternative currencies amid a general deterioration of interest in them on social media sites. This investor calm reflects a similar scenario to that of 2019. Social interests also declined before the interest rate cut. The ALT/BTC index reached its lowest levels, coinciding with the Federal Reserve's policy change.

May could be a tough month for Bitcoin and the entire market

I continued Bitcoin Prices Its successive losses, currently trading at levels of $56,500. After the collapse of the FTX platform in November 2022, April 2023 was the worst performing month for Bitcoin. Market analysts expect Bitcoin to fall to $52,000 if it falls below $58,000 – the 100-day moving average level.

To wait for Analyst Patrick H predicts a period of intense emotional volatility for Bitcoin and altcoin investors next May. A final shock is likely to occur over the next 2-6 weeks before a possible price launch. He highlighted the general state of euphoria indicated by the Fear and Greed Index, which could harm markets.

Patrick added: “The market is losing momentum with continued outflows from Bitcoin ETFs. This is associated with the poor performance of the Hong Kong ETF, which recorded a trading volume of only $11 million (instead of the expected $300 million). “This is a huge disappointment to investors.”

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,أفضل العملات الرقمية البديلة,العملات الرقمية,بيتكوين

Comments

Post a Comment