May 2024 is expected to be a pivotal month for the cryptocurrency market, affected by several critical events that could shape its evolution.

From key economic indicators to important regulatory decisions, here's a look at what market watchers can expect this month.

Macroeconomic Factors: Federal Reserve Meeting and April CPI Report

Among the most anticipated events is the Federal Open Market Committee (FOMC) meeting of the Federal Reserve, which ends on May 1. Despite ongoing concerns about persistent inflation, The Fed should keep its borrowing rate stable Between 5.25% and 5.5%.

The move could signal a continued conservative approach amid economic uncertainty, which would impact investor confidence in the cryptocurrency sector.

On May 2, the US Treasury is expected to announce on Repayment plans for the next quarter, which could provide some relief to the markets. After three consecutive quarters of increasing auction sizes, Treasury plans to keep most auction sizes stable.

Investors are paying close attention to the details of the expected debt buyback program and its implications for long-term U.S. financing strategies amid growing debt concerns. Although there may be an increase in specific issues such as the 10-year Treasury Inflation-Protected Securities (TIPS). Most auctions are expected to remain unchanged, which could affect market liquidity and interest rates.

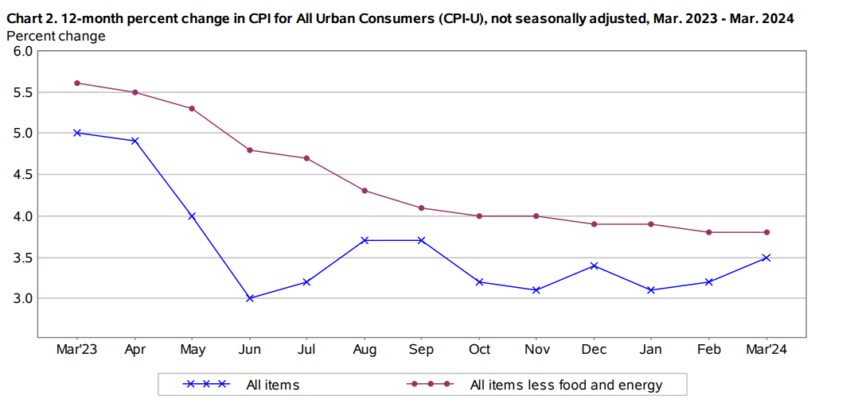

Another notable development is the April Consumer Price Index (CPI) report on May 15. Given that housing costs contributed to more than half of the 3.5% CPI inflation rate In March 2024 The financial market will closely monitor this report. Any major changes may affect the monetary policy of the Federal Reserve, thereby affecting the stability of the cryptocurrency market.

Spotlight on Hong Kong: Bitcoin Asia Conference

On the world stage, the Bitcoin Asia conference in Hong Kong on May 9 and 10 stands out as a major event. This conference will bring together personalities from the cryptocurrency, blockchain and traditional finance (TradFi) sectors. Including Han Tongli of Harvest Global Investment Limited and Elizabeth Stark of Lightning Labs.

The ideas and developments shared here could impact market trends. Especially since Hong Kong adopts Bitcoin and Ethereum ETFs.

Legal Challenges: The Tornado Cash Trial and Its Repercussions On the cryptocurrency market

The market is also monitoring legal proceedings against Tornado Cash developer Alexey Pertsev in the Netherlands, with a decision expected on May 14. Burtsev faces money laundering charges, with prosecutors recommending 64 months in prison.

BeInCrypto reported in August 2022 that the Dutch criminal agency FIOD. Burtsev was arrested in Amsterdam After the sanctions imposed by the US Treasury on Tornado Cash. FIOD alleged that Persev facilitated illicit financial flows, money laundering and cryptocurrency mixing. Thanks to the decentralized Ethereum mixing service, Tornado Cash.

Meanwhile, other Tornado Cash developers in the United States, Roman Storm and Roman Semenov, faced Multiple Department of Justice (DOJ) charges. The charges include conspiracy to launder money, operating an unlicensed money transfer arrangement and violating sanctions imposed by the Office of Foreign Assets Control.

The crypto community is eagerly awaiting the outcome of the Tornado Cash case. Which, he fears, would set a precedent that threatens privacy-focused software developers within the ecosystem.

SEC Decisions: Fate of Ethereum and Bitcoin ETFs

At the end of the month, the cryptocurrency community is also awaiting answers from the US Securities and Exchange Commission (SEC). ETF fund creation requests Instant Ethereum. The spotlight is on the orders of VanEck and ARK. May 23 and 24 are respectively set as deadlines for decisions by the United States Securities and Exchange Commission (SEC).

Despite this anticipation, skepticism is high among industry experts regarding SEC approval. Jan Van Eck, CEO of VanEck, suspects: In the approval boxes ETFs Instant Ethereum.

“The way the legal process works is that regulators will give you feedback on your application, and that happened weeks and weeks before Bitcoin ETFs – and right now the pins are down in terms of Ethereum,” Van Eck explained earlier in April.

VanEck is not the only one to be pessimistic. Industry analysts like James Seyphart and Eric Balchunas of Bloomberg Intelligence share this sentiment. Balchunas himself reduced his chances of approval from 70% to less than 35%.

In addition to Ethereum ETF filings, the U.S. Securities and Exchange Commission (SEC) has also postponed decisions on options trading for Bitcoin spot ETFs.

A recent opinion indicated that The Commission It set May 29, 2024 as the deadline to approve, disapprove or initiate a procedure to decide on rejection. Which allows the NYSE to list options on potential Bitcoin ETFs.

Collectively, these events are likely to impact the stability or volatility of the cryptocurrency market throughout May 2024. The cryptocurrency community remains on high alert, ready to deal with the consequences of these developments .

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار أسواق العملات المشفرة,العملات المشفرة

Comments

Post a Comment