In today's analysis, we will examine the recent price action and on-chain activity of Avalanche (AVAX) to understand fundamental trends and potential future movements.

Bitcoin's 22% correction from its all-time highs pushed AVAX to trade near the critical $30 support level, sparking fear among holders. Are you wondering about the reasons for this behavior? Let's go over the details.

AVAX coin is trading above a pivotal support level

The chart below shows Avalanche price action over a 4-hour time frame. The red lines highlight key support and resistance levels. Currently the price is around $32. A drop below the $30 range could trigger a series of liquidations, pushing the price further down.

The $30.74 level, near the $30 mark, is in line with the 0.618 Fibonacci line and is considered vital support. Monitoring these levels will help investors and traders anticipate potential price movements.

The main resistance levels to watch are $33.26 (200 EMA), $34.06 (100 EMA), and $39.78. The 100 and 200 EMAs on a 4-hour time frame are important indicators because they can act as trendline resistance in a downtrend.

Additionally, the Ichimoku cloud is currently in a crucial resistance zone. If AVAX breaks the cloud, it could indicate a price recovery.

Avalanche Analysis: Exploring Blockchain Metrics the basics

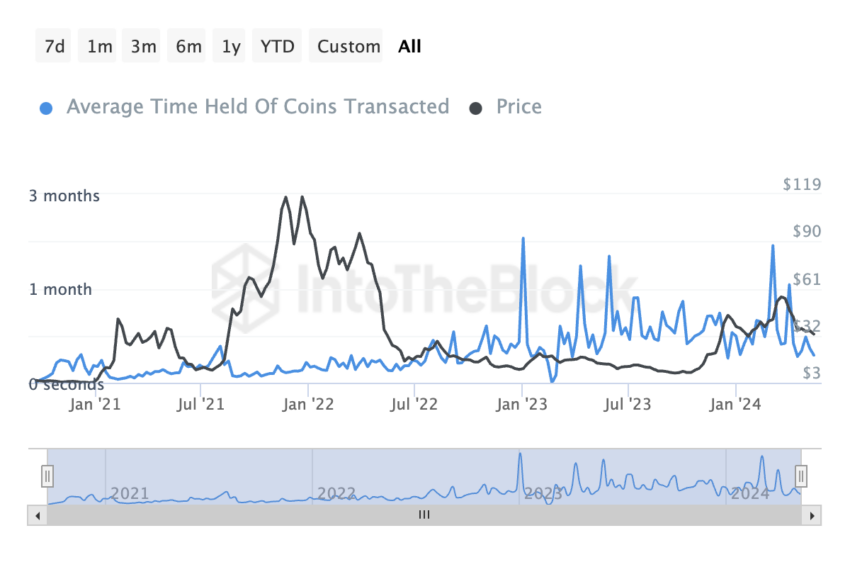

Avalanche's average holding period has declined to levels seen during the Q4 2022 bear market. This suggests that investors are holding their currencies for shorter periods, indicating increased trading activity and lower confidence in the long-term holding of AVAX.

As the holding period decreases, more investors appear to be trading AVAX rather than holding it. This increased activity may lead to greater price volatility.

A low holding period reflects bearish market sentiment. Investors are less confident in AVAX's long-term potential and prefer to trade rather than hold positions for long periods.

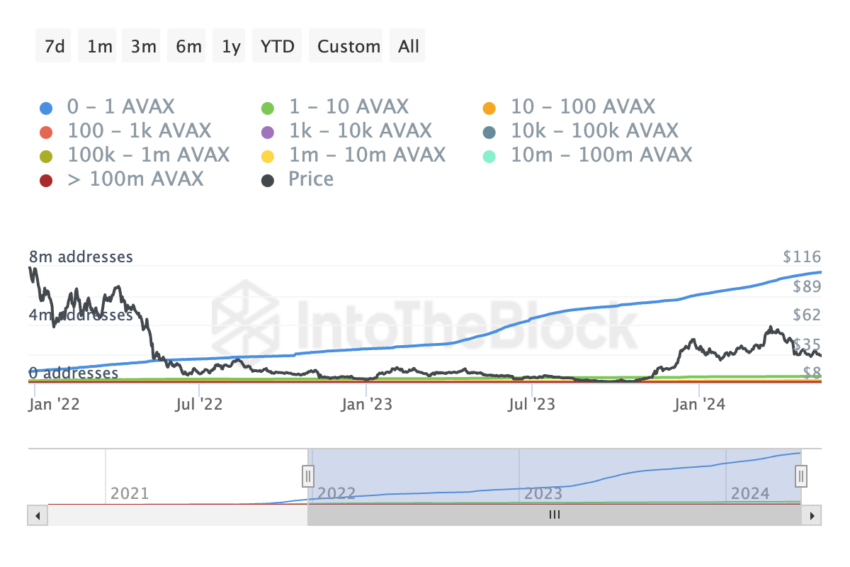

At the time of writing, there are over 2 million small AVAX holders in balance or loss. This situation can increase selling pressure, as these investors may decide to sell to cut their losses, which will cause the price to fall further.

The vast majority of addresses are held between 0 – 1 AVAX and 1 – 10 AVAX, indicating a large number of small holders. The stability of larger holdings indicates that major investors are maintaining their positions.

Many small holders in balance or loss reflect cautious market sentiment. These holders are more likely to sell under pressure, which can lead to increased volatility and further price declines.

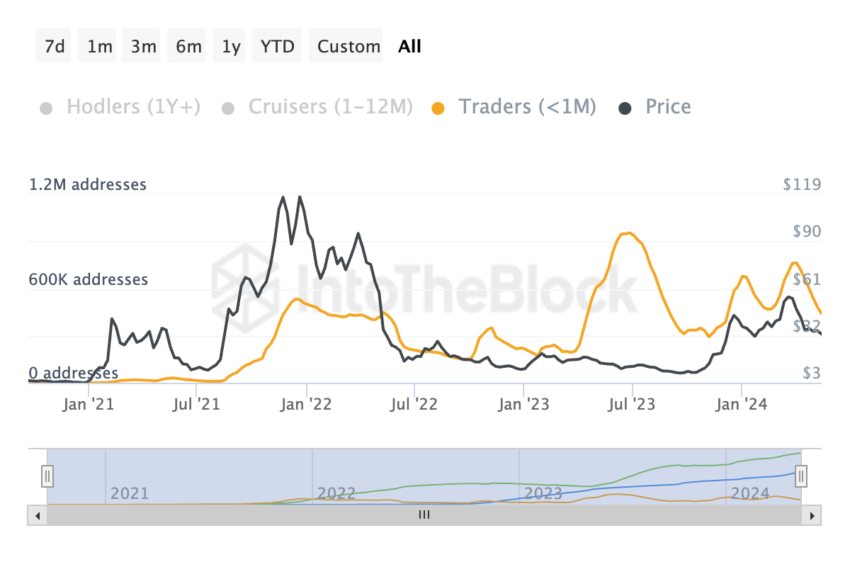

The number of addresses holding AVAX for less than a month has decreased significantly. This means that holders who recently purchased AVAX are exiting the market and cutting their losses. While the number of short-term traders may reduce immediate price volatility, it also means less buying support from this group. This can make the price more vulnerable to downward pressure from other areas of the market.

Strategic Recommendations in Light of Bitcoin Influence

- Neutral to bearish outlook: AVAX price is struggling below the $30 support level, showing weakness after Bitcoin corrected from its all-time highs. This sparked fear among holders, with short-term investors withdrawing to cut their losses.

- Bitcoin effect: If Bitcoin continues its bullish momentum and approaches its all-time highs, this could have a positive impact on the price of AVAX.

- Conditional support: If Bitcoin continues to decline, AVAX could face a notable price decline in the medium term, possibly falling below the critical support level of $30.

- Price forecasts and recommendations: In a bearish scenario, AVAX could fall to $25 if the price of Bitcoin declines. To reduce exposure risk, traders should wait for the price to drop below $30 before buying. The ideal buying range would be between $25 and $27 to get the best entry position. It is recommended to set a stop loss at $24 to manage potential risks and to target a sale price between $40-50 to benefit from the next bullish wave.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,تحليل الانهيار الجليدي (AVAX)

Comments

Post a Comment