In today's analysis, we will examine the recent price action of Chainlink Coin (LINK) and its on-chain activity to understand the underlying trends and potential future movements.

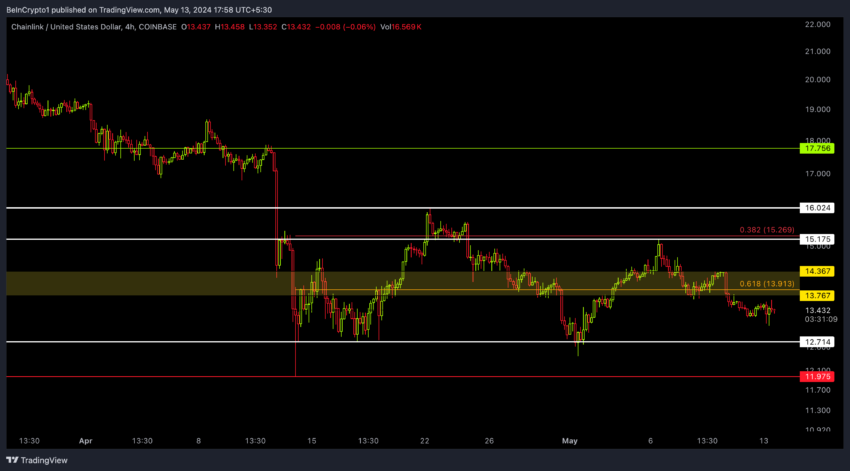

Although Bitcoin price rose from $60,700 to $63,000 in a matter of hours. Chainlink price failed to breach the main medium-term resistance level at $13.7. Curious to know why? Let's zoom in for a closer inspection.

Chainlink price action remains bearish

LINK's current price is trading below a broad yellow band, which is a crucial thing to watch over the coming days. This range can act as a resistance level. The fact that the price remains below this range indicates bearish market sentiment.

Interestingly, even though Bitcoin recovered to $63,000 yesterday, LINK did not show a similar price rise, which is in line with... Downward trends Which is observed in similar tokens such as PYTH. Additionally, the decline in trading volume contributed to a deep price correction.

Key notes:

- Resistance monitoring: The yellow range is crucial. A break above may indicate a bullish reversal, while persistent resistance confirms bearish pressures.

- Poor comparative performance: Unlike Bitcoin, Link's lack of recovery is a cause for concern, reflecting broader market uncertainty or specific challenges within the Chainlink ecosystem.

- Size trends: A decrease in trading volume, coupled with a decrease in stock market activity, indicates a lack of trader confidence, which may lead to further price declines.

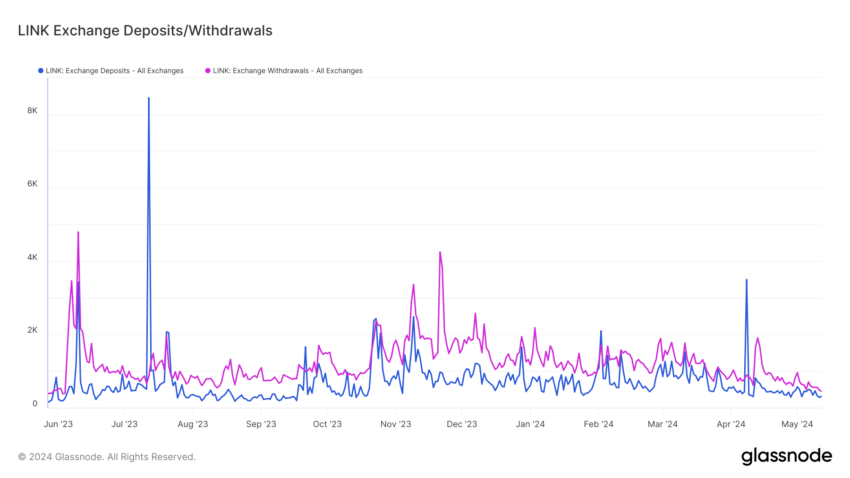

A closer look at on-chain metrics reveals that exchange deposits and LINK withdrawals have significantly decreased, resulting in very low trading volumes. This decrease in active trading volume is a bearish indicator and indicates that the price could continue to face downward pressure, potentially reaching the key medium-term resistance level at $11.9.

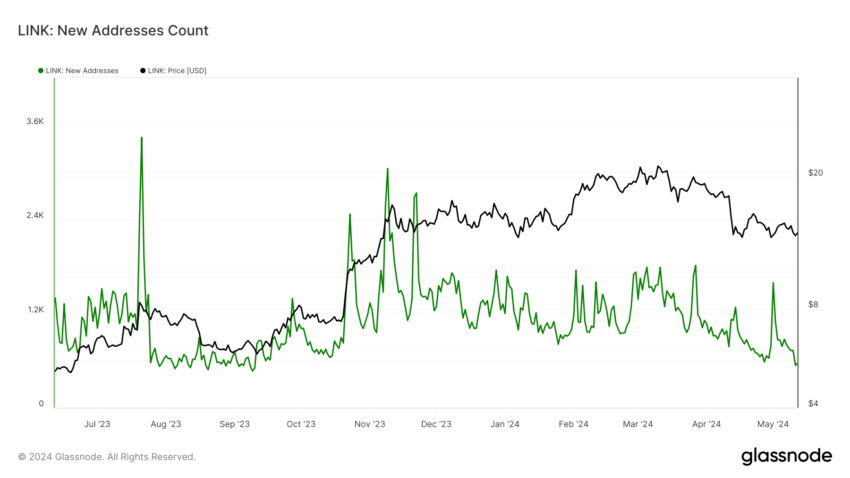

Additionally, there has been a notable drop in the number of new addresses created on the Chainlink network, as shown in the provided chart.

This drop in active address generation is closely linked to the drop in the price of LINK, which confirms the drop in demand from new investors in the market.

Chainlink is currently showing several bearish signs. The key to its near-term price action will be its ability to break above the observed resistance band. Investors should monitor trading volumes and stock market activity as indicators of potential changes in market sentiment.

Learn more: Chainlink (LINK) Price Forecast for 2024, 2025, 2026, 2027

As always, it is essential to approach trading with caution, taking into account the volatile nature of cryptocurrency markets.

LINK Coin Price Prediction: How BTC Could Affect the Price

- Outlook: Bearish to Neutral: Chainlink price is struggling below key resistance, with trading volumes falling and exchange activity falling. This indicates strong bearish signals amid a lack of interest from new investors.

- Bitcoin effect: If Bitcoin continues its bullish momentum towards $65,000, it could have a positive impact on Chainlink.

- Conditional resistance: If Bitcoin price falls below $60,800, LINK could see a notable price decline in the medium term, which could extend its downtrend.

- Price forecast: In a bearish scenario, LINK price would likely fall to $11.9.

- Our recommendations for traders: If Bitcoin hits $60,800, expect LINK to decline by 12%. A BTC price of $65,000 could push LINK to $15. Traders should consider waiting to buy LINK at a lower price, between $12 and $12.5. Setting a stop loss at $11.5 and targeting a sell price of $15 might be a smarter move.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment