Bitcoin prices observed BTC Quiet trading this weekend, after several days of extreme volatility that took it to a two-month low of $56,600, before returning and stabilizing above the $64,000 threshold.

The main driver of these fluctuations has been the risk appetite of financial markets. Which reacted strongly to the various developments and data published by the American economy, in particular the question of interest rates, which concerns everyone, including of course the digital currency market.

This confirmed the events of last week The End of Bitcoin ETF Momentum And its significant impact on prices, which recorded the largest volume of daily negative flows.

This does not mean that it has lost its importance, but it has now reached a stage of stability and integration into the market. The evolution of inflows and outflows has become one of the many variables that control the prices of the largest currency on the market.

Many analysts believe that much institutional investment capital has not yet flowed into these funds. This will happen gradually over the long term. And not like the initial strong stampede.

US Interest Rates Lead Bitcoin Moves

decreases Bitcoin prices hit their lowest level in two months, falling more than 23% from their all-time high of $73,800.

It was the worst monthly performance since digital currency trading platform FTX collapsed amid investor fears over rising interest rates.

The decline was not limited to the digital currency market alone, but rather extended to most global financial markets. Due to economic uncertainty and new fears of stagflation in the United States. This means that high interest rates will remain high for longer than expected.

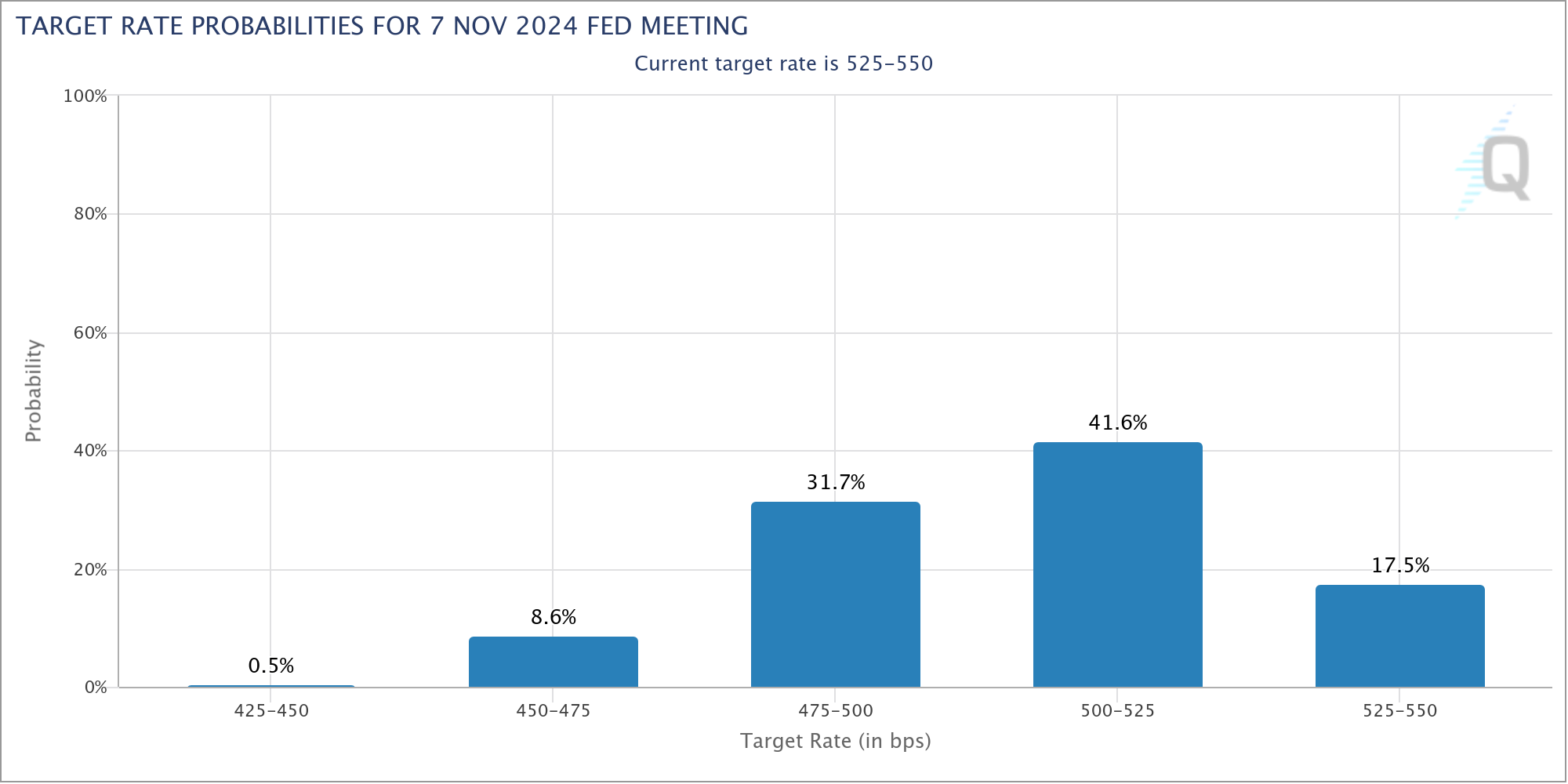

This was later confirmed The Federal Reserve has maintained On Wednesday, the benchmark interest rate remained unchanged between 5.25% and 5.5% as expected.

At the press conference, Powell said the economy is very strong and does not require interest rate cuts.

But at the same time, he played down the prospects of interest rate hikes or liquidity tightening caused by recent disappointing inflation figures.

This reduced market fear and slightly increased risk appetite – which was reinforced by weak data from Friday's monthly jobs report.

Which has renewed optimism that the Federal Reserve may begin to cut interest rates. The price of Bitcoin and most digital currencies increased immediately afterward.

According to Data from the CME FedWatch tool Investors are now in the markets. They plan to cut interest rates by more than 80% twice this year. Over the next few months of November and December, expectations exceeded employment data only once during the month of December.

Technical forecasts of Bitcoin (BTC) price movements.

In previous analyses, we expected a continuation of the decline Bitcoin BTC Price Towards the $52,500 level after breaking the $60,500 pivot support, but it was wrong.

The reason, as we said, is the release of negative economic data in the United States, which could push the Federal Reserve to lower interest rates sooner than expected.

With the price returning above the pivotal support level mentioned above, it appears that we have returned to the limited sideways trading range between $60,500 and $71,000. Especially with the upper border of the descending price channel breaking.

likely to be respected BTC Price During its movements, whether upwards or downwards, the technical levels indicated on the chart, including Fibonacci retracements.

Overall, a breakout of $60,500 remains a sign of further decline. Breaking the 73,800 level and closing above it is a prerequisite for continuing the ascending wave towards the psychological level of $80,000.

But the chances of this happening remain low at present, as the market will enter a phase of waiting for US macroeconomic data.

Of course, unless surprises arise, as is always the case in the digital currency market.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any actions, actions or decisions taken by the reader in accordance with this information are solely the responsibility of the reader and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,تحليلات,تحليلات تقنية,تقرير إخباري,العملات الرقمية,بيتكوين,سعر بيتكوين

Comments

Post a Comment