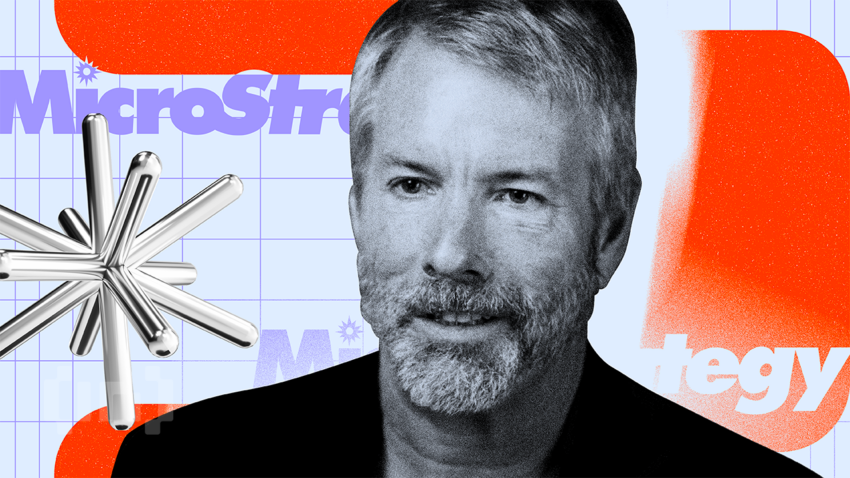

Michael Saylor, CEO of MicroStrategy, predicted that the United States Securities and Exchange Commission (SEC) would classify Currency Ethereum (ETH) As “security”. Saylor believes that this classification will subsequently lead the authority to reject applications currently submitted to launch exchange-traded funds (ETFs) that track the price of Ethereum in the spot market.

Saylor's predictions came during his participation in the World MicroStrategy 2024 conference. He also highlighted that other alternative digital currencies (Altcoins) such as BNB, Solana (SOL), XRP and Cardano (ADA), will be at their tour classified in the ranking. list of “papers”. Unrecorded finances.

“None of them will be traded via spot ETFs, nor will they be accepted by Wall Street,” he added.

Saylor highlighted the distinction between Bitcoin (BTC) and other digital currencies. Considering it the only widely accepted “institutional digital asset”. He emphasized that no other digital asset will achieve the same level of institutional adoption.

It is worth noting that Michael Saylor is one of the most prominent supporters of Bitcoin, and his statements come days after his company, MicroStrategy, announced... Its acquisition of 1.65 billion Additional dollars of BTC during the first quarter of the year. This announcement coincided with release The company makes a decentralized product based on Bitcoin.

Crucial decisions regarding Ethereum

Despite the initial optimism that prevailed in the markets regarding the approval of the launch of Ethereum spot ETFs, Expectations have diminished strongly in recent weeks.

Analysts also revised their previous expectations of a decline in the approval rating from above 80% to below 30%.

The Securities and Exchange Commission is expected to announce its decision on VanEck's application to launch an ETF on May 23. Which constitutes a crucial date. The Authority is expected to issue decisions on similar applications simultaneously.

The authority must also clarify whether it classifies Ethereum as a “security” or not. In this context Survey Lawsuit from blockchain developer Consensys. Legally forcing the SEC to clarify that Ethereum is not.

Members of the US Congress have also requested clarification from the authority regarding the status of the currency, particularly in relation to Prometheum.

The classification debate is believed to have been resolved Ethereum ETH currency This will determine how businesses manage this digital asset in the future. But it could also impact the SEC's decision to allow Ethereum ETFs to trade. In addition to the extent to which businesses are willing to deal with this currency in the absence of appropriate legal regulation.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,الأسواق,قضايا,إيثيريوم ETH,العملات الرقمية,صناديق ETF

Comments

Post a Comment