I witnessed Ethereum Price Up 35% in the second half of May, driven by improving market sentiment and the approval of Ethereum spot ETFs by the U.S. Securities and Exchange Commission. Analysts expect strong demand for these funds when they officially launch for trading, which will strongly support the price of the second largest digital currency on the market.

After a big rally last Monday, Ethereum moved sideways for the rest of the week. This slowdown is likely because the previous approval was preliminary and not final.

The Securities and Exchange Commission (SEC) has given approval to Forms 19b-4 for Ethereum ETFs. From now on, candidates for the creation of these funds must obtain another so-called final approval. S models before their entry into circulation.

Historically, this process can take anywhere from several weeks to several months, meaning there is no specific date.

Strong demand for Ethereum whales

Cryptocurrency investors expect significant institutional demand for Ethereum (ETH) in the coming weeks.

In anticipation of this influx, many large Ethereum investors have made significant purchases since the approval of the Ethereum ETF was announced.

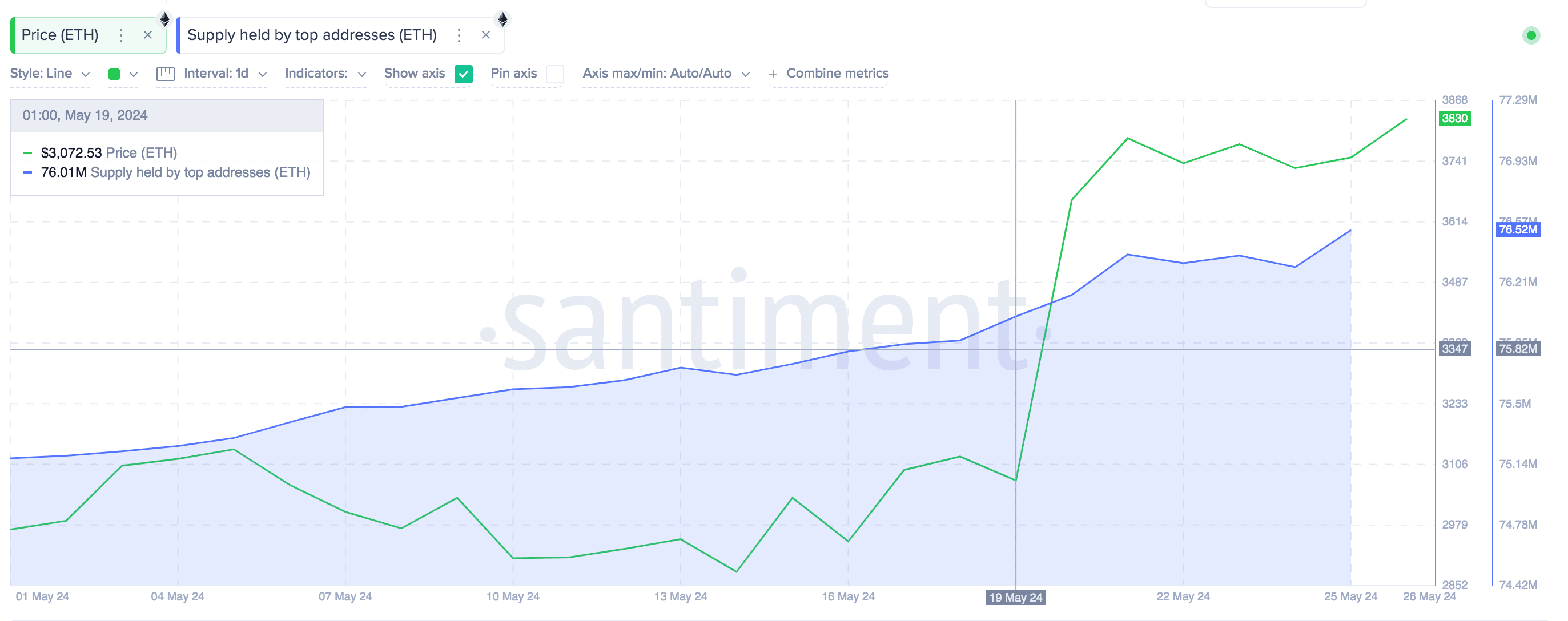

Data from Santiment showed a significant increase in purchases by major Ethereum investors. They have been called “whales” since the SEC announced its approval of Ethereum ETFs. The holdings of Ethereum's top 1,000 custodians increased by 510,000 ETH in just five days, reaching 76.52 million ETH.

Bloomberg analyst James Seyfart predicts that demand for Ethereum spot ETFs could reach 20-25% of the demand seen for Bitcoin spot ETFs.

His analysis takes into account the current size of the Ethereum market, which is approximately 30% of the size of the Bitcoin market.

Seyfart also highlighted some of the downsides of investing in Ethereum ETFs. Among them, these currencies cannot be mortgaged to obtain returns. It cannot be leveraged for other operations within the blockchain network, which may also generate returns.

For example, in the current normal case, investors can buy Ethereum currency (ETH) and then stake it to mine the network in exchange for returns. And when sold later it will increase ETH Price The investor benefits from mortgage yields and rising prices.

But in the case of ETFs, you can only benefit if the price increases. This fact may reduce the attractiveness of these funds for many investors compared to Bitcoin. Who may prefer to invest in the normal way to increase their profits.

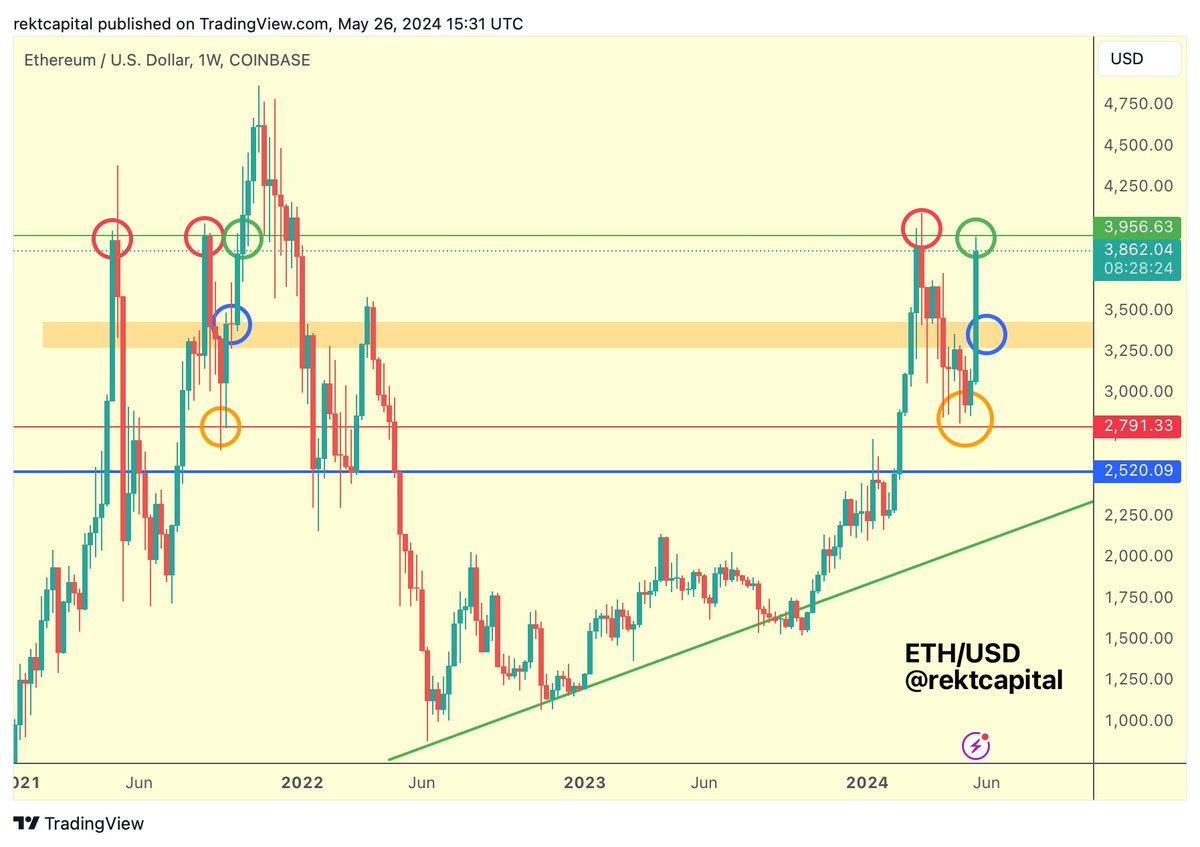

Ethereum Price (ETH) seeks to reach $4,500

Cryptocurrency analysis company, Rekt Capital, See Than the price of Ethereum (ETH) is expected to see a weekly close above $3,956 to break out from the $4,000 range. This will confirm that the bulls have regained momentum.

As for the founder of DeFiance Capital, So he expects Arrive Ethereum (ETH) Price) to $4,500 before Ethereum spot trading funds even started trading.

This optimistic outlook is supported by an opinion poll conducted by renowned Chinese cryptocurrency analyst WuBlockchain among investors in China, which showed that 58% of respondents believe that... ETH Price It could reach $10,000 or more in the current market upcycle.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,تحليلات,تحليلات تقنية,SEC,الإيثريوم,العملات الرقمية,العملات المشفرة

Comments

Post a Comment