MicroStrategy CEO and co-founder Michael Saylor appears to be reassessing his stance on Ethereum following the U.S. Securities and Exchange Commission's (SEC) approval of spot exchange-traded funds (ETFs).

In a recent episode of the “What Bitcoin Do For Me” podcast, Saylor described the SEC’s decision as positive news for Bitcoin and the entire crypto industry.

Ethereum ETF approval signals further support for cryptocurrencies

According to Saylor, the SEC's recent approval of several Ethereum ETFs demonstrated the crypto industry's growing political influence. Last week, the financial regulator unexpectedly approved several financial instruments linked to ETH. Many in the industry have suggested the turnaround could be politically motivated.

Thus, many stakeholders suggested that the endorsement highlighted a positive change in the president's attitude. Joe Biden Towards cryptocurrencies.

"Is it good for Bitcoin or not? Yes, I think it's good for Bitcoin, in fact I think it might be better for Bitcoin because I think we are more politically powerful and supported by the whole of the crypto industry,” Saylor said.

Michael Saylor thinks so Ethereum ETF This will boost institutional adoption of cryptocurrencies. According to him, more institutions will now recognize cryptocurrencies as a legitimate asset class and allocate capital between various cryptocurrencies. However, this confirms that Bitcoin will get the largest share of these investments as the “leader” of the market.

“I think traditional investors would say now there is a crypto asset class, maybe we will allocate 5% or 10% to the crypto asset class, but Bitcoin will be 60% or 70% of that,” Saylor noted.

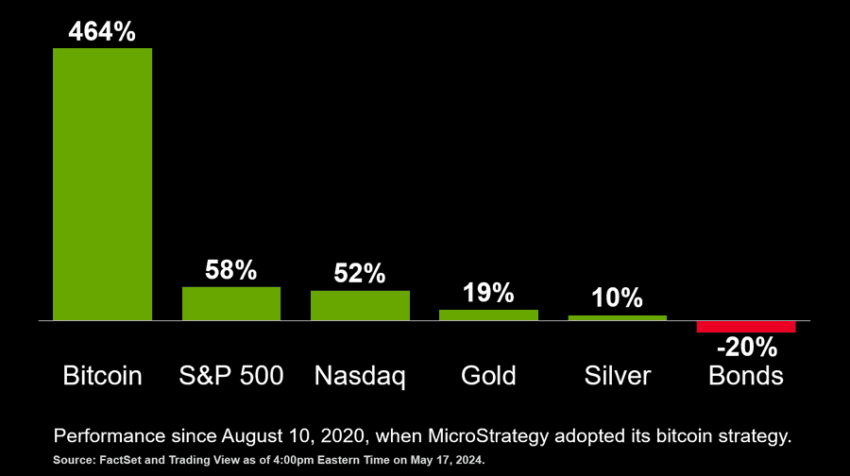

The president of MicroStrategy also took the opportunity to express his confidence in the future of Bitcoin. Saylor and his company are prominent in major cryptocurrencies and have always maintained a pro-BTC disposition. The Virginia-based company is the largest public holder of Bitcoin and has amassed more than 214,000 BTC, worth around $15 billion.

“I'm quite optimistic, I actually believe that Bitcoin will succeed, it will succeed, it will succeed as quickly as it can reasonably succeed, and we should try to avoid the tendency to (mess) with it,” he said. declared. He said Marine.

Meanwhile, Saylor’s current position on Ethereum has changed significantly from his previous position. Previously, it was reported that the SEC would classify ETH as a security under its regulatory jurisdiction. He predicted that other cryptocurrencies including BNB And Solana And XRP will suffer the same fate.

“None of (these tokens) will be wrapped by a spot ETF, none will be accepted by Wall Street, and none will be accepted by major institutional investors as crypto assets,” he said. claims.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,أخبار الإيثيريوم (ETH)

Comments

Post a Comment