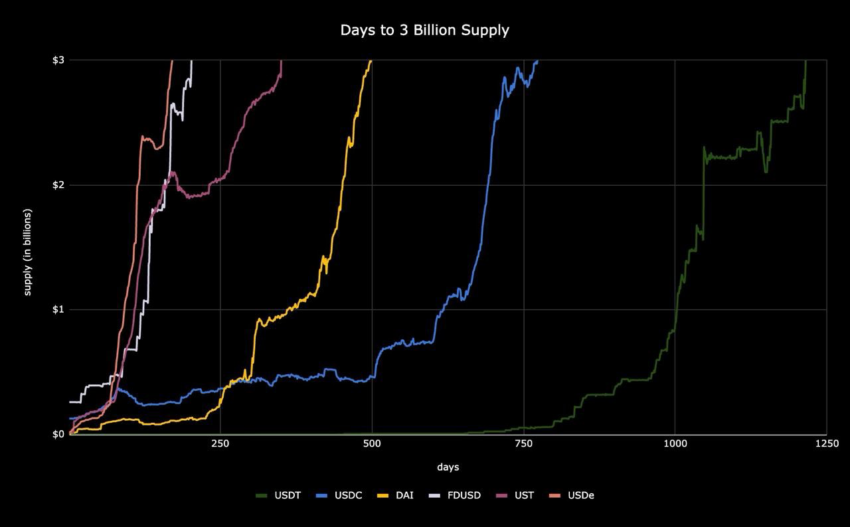

Athens' digital stablecoin, USDe, quickly reached $3 billion just four months after its launch. This achievement highlights the growing demand and trust in stablecoins within the decentralized finance (DeFi) ecosystem.

Stablecoin Athena (USDe) crosses the $3 billion mark

USDe is a dollar-pegged stablecoin created by Ethena Labs. It generates returns by storing ETH and managing derivatives, and is built on the Ethereum blockchain. Additionally, USDE is fully supported on-chain and can integrate with other blockchain protocols.

As of June 2, USDe's market valuation was approximately $3.02 billion, surpassing First Digital's FDUSD with a bid of $2.9 billion. This achievement made USDE the fourth largest stablecoin. Athena founder Guy Young noted: has USDe became the fastest dollar-pegged asset in crypto history to reach this level.

According to EtherScanUSDe manages approximately 13,235 unique addresses. The Athena smart contract holds the largest share at $1.22 billion, or over 40% of the total supply, while the LP storage address holds $511.2 million, or 16.8%. Other significant holders include Pendle Finance, Morpho and Zircuit.

👈Read more: Best stablecoins in 2024: USDT or USDC?

However, there are concerns about Athens' rapid growth. DeFi expert Andre Cronje has warned that USDe could face a collapse similar to that of the Terra stablecoin (UST) due to its use of perpetual contracts and reliance on yield-based collateral. CryptoQuant founder Ki Young Ju also echoed this sentiment, questioning his ability to maintain a delta neutral strategy during bear markets.

Despite criticism, the project continues to gain traction. At the time of writing, Ethena offers an annual yield (APY) of 33.5% for its stablecoin, which attracts many DeFi enthusiasts. If 200,000 users have already joined the platform, new participants still need an invitation code.

👈Read more: ByBit exchange uses stablecoin USDe as collateral for transactions

In conclusion, the rapid growth of USDe, reaching $3 billion in a short period, highlights the growing demand for innovative stablecoin solutions. Athena's success demonstrates the viability of synthetic stablecoins and sets a new standard in the DeFi space, signaling their future adoption.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بلوك تشين

Comments

Post a Comment