Bankrupt cryptocurrency exchange FTX has agreed to sell its remaining stake in artificial intelligence startup Anthropic for $452.2 million, according to a May 31 court filing.

FTX revealed that G Squared, a global venture capital fund, purchased about a third of 4.5 million shares for $135 million. More than 20 other venture capital funds also participated in the purchase. Including Gemini Ventures, FG-BLU Fund and SCVC-PV-LXVI Fund.

FTX nets $800 million from Anthropic stock sales

The sale of FTX shares in Anthropic, which is still awaiting approval from Judge John Dorsey, could reach around $1.3 billion. Which brings the company about $800 million. Initially, the bankrupt exchange invested $500 million in Anthropic in 2021, holding a 7.8% stake.

Anthropic, an AI company known for its Cloud chatbot, aims to release AI models with stronger guardrails than ChatGPT and other competitors. Founded by former OpenAI employees, Anthropic has attracted significant investment from tech giants such as Google.

The sale could be the most profitable for FTX as it seeks to repay its creditors following its bankruptcy in November 2022. However, Argument Some creditors argue that the shares should have gone to customers of the disreputable exchange, whose deposits financed the purchase.

👈Read more: An investment in the FTX platform can compensate all customers

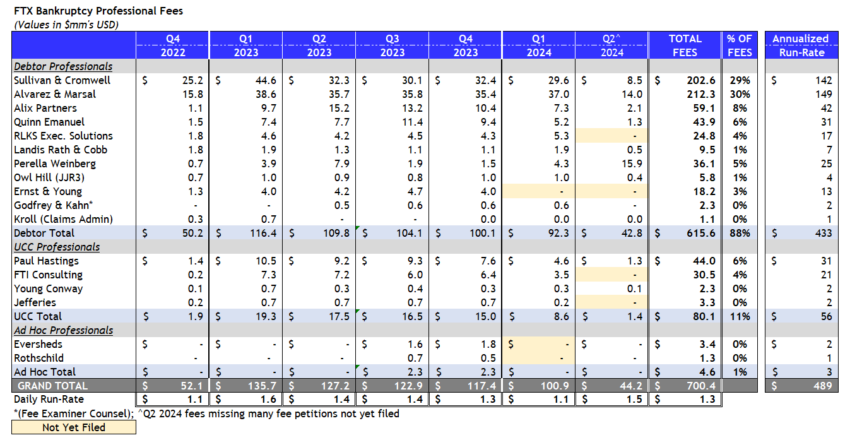

Additionally, FTX's high legal fees have drawn sharp criticism from creditors of the bankrupt exchange, who accuse advisers of destroying more than $10 billion in creditor value. Recent bankruptcy filings reveal that the exchange incurred $700 million in legal and administrative costs. Also followed by user X Mr. Purple. The consulting firm Alvarez & Marsal received $212 million. While legal advisor Sullivan & Cromwell issued an invoice worth $202 million.

Additionally, FTX CEO John Jay Ray III charged $5.6 million at a rate of $1,300 per hour.

“FTX advisors charged $700 million while destroying over $10 billion in value to creditors. John Ray received $5.6 million for making all business decisions, such as not restarting FTX despite multiple offers and selling assets at a 90% discount. change, "books The FTX creditor, Sunil Kavori.

👈Read more: What are the practical advantages of blockchain? Are there real uses in daily life?

FTX's efforts to sell Anthropic's stake and manage mounting legal fees remain under scrutiny as it faces complex bankruptcy proceedings. The results of these sales and the decisions of Judge John Dorsey will also be instrumental in shaping the future of the stock market and the recovery prospects of its creditors.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق

Comments

Post a Comment