The price of Bitcoin is booming (BTC) with bullish indicators including the continued growth of wallets holding at least 1,000 BTC over the past five days. Meanwhile, Bitcoin supply on Coinbase fell to its lowest levels since 2018. Underscoring a significant withdrawal of Bitcoin from exchanges.

This scarcity on trading platforms, combined with technical momentum as the short-term exponential moving average (EMA) lines have crossed above the long-term lines. Which opens the way to a potential increase. These elements indicate an impending bullish trend, painting a hopeful picture for the future of Bitcoin.

Whales are accumulating Bitcoin again

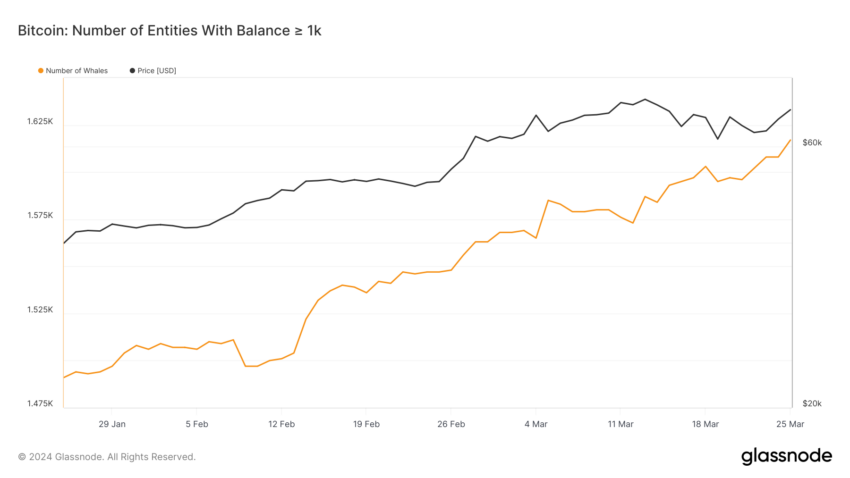

Between January 25 and March 25, the number of Bitcoin addresses holding at least 1,000 BTC increased from 1,491 to 1,617 addresses. This rise represents the largest number of Bitcoin whales since February 2021. This is another indication of institutional interest in Bitcoin.

The increase in whale activity has been particularly evident over the past five days. This number increased from 1,596 to 1,617. Such an assertive rise in headlines can serve as an indicator for the market as a whole. Which indicates that an uptrend could be imminent.

A strong takeover by these whales is often seen as a positive sign for the market. This indicates that well-capitalized players are preparing for an upward shift in Bitcoin’s price trajectory. As a result, this can inspire more confidence in individual traders and smaller institutions.

If they interpret the whales' investment behaviors as reliable predictions, they could increase their market participation. Which risks increasing prices. So, observing these pods of whales can provide insight into potential large-scale market movements. Their purchasing habits could be a harbinger of major price increases in the Bitcoin ecosystem.

Read more: Cryptocurrency platforms in 2024: The 4 best platforms!

Coinbase Auction Reduction

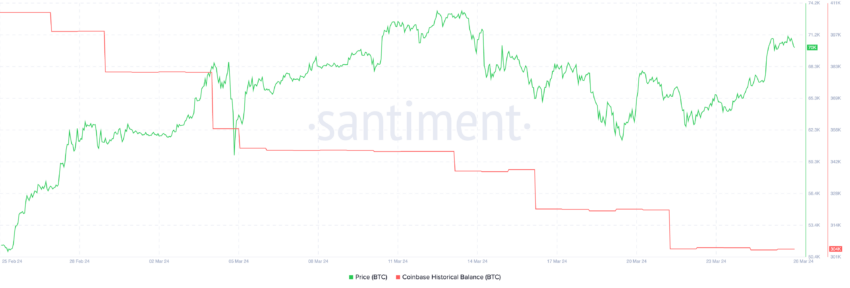

Bitcoin supply on Coinbase, the largest US exchange, has been in steady decline since the start of the year, recently peaking at just 304,000 BTC. This high number represents the lowest Bitcoin supply level on Coinbase since 2018, highlighting the decreasing availability of Bitcoin on the marketplace platform.

This drop in supply, particularly on a leading exchange platform like Coinbase, is also a notable development. This indicates a decrease in the supply of Bitcoin available for trading and purchasing.

A tight supply often precedes an increase in prices, as the basic economic principle of supply and demand suggests. In the context of Bitcoin, a decrease in supply on a major exchange indicates that fewer Bitcoins are available to buyers. It also reflects broader market sentiment favoring holding over selling, suggesting investors are optimistic about future price movements.

This scenario sets the stage for a possible rise, as lower supply at Coinbase could lead to increased competition among buyers, leading to higher prices. In addition to the increasing number of whales that have been accumulating Bitcoin recently, the current supply dynamics on Coinbase could be the precursor to a significant upward trend in the price of Bitcoin.

Bitcoin price forecast: soon a new all-time high?

The BTC 4-hour chart shows a bullish signal. The short-term EMA line has crossed above the long-term EMA line, indicating strong buying pressure and a possible continuation of the current uptrend. Exponential moving average lines, or EMAs, are trend indicators that place more weight on more recent price data, making them more responsive to price changes than simple moving averages. This response can provide early signals of a change in market sentiment.

The recent crossover, often seen as a bullish signal, could be the precursor to a strong upward trajectory, which could push Bitcoin towards a new all-time high (ATH) if the trend gains enough momentum and investor confidence remains high . The current ATH is $73,797.35, and with Bitcoin approaching the new halving every day, reaching a new ATH for Bitcoin shouldn't seem crazy.

Conversely, if this upward trend loses steam or if factors external to the market create uncertainty in the market, there is a risk that the price of Bitcoin will decline. If buying pressure eases and the market is unable to maintain the bullish momentum indicated by the crossover EMA, Bitcoin could retest lower support levels, potentially reconsidering the $60,000 level.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة,بيتكوين,كوين بيز

Comments

Post a Comment