The price of Bitcoin Cash (BCH) is once again trying to break its highest level since the beginning of the year, although this may not happen as it seems. Several reasons contribute to this bearish outlook, but the situation could reverse if BCH reaches a crucial support level.

Bitcoin Cash (BCH) Whales Indicate Pullback

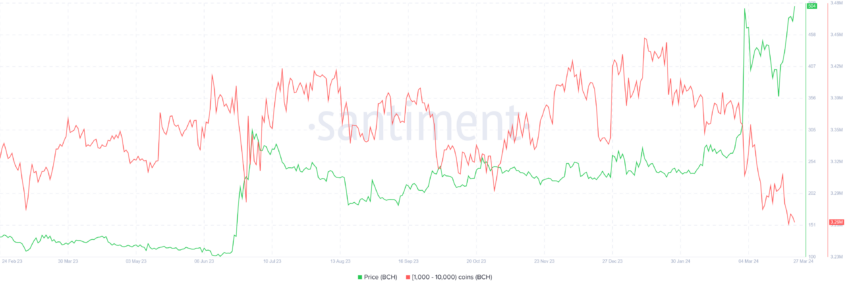

He'll probably put up with it Bitcoin Spot Price The effect of the downward trend shown by whales. These large investors in the portfolio tend to influence the direction of price movement. Historically, their selling has led to corrections, while their accumulation has led to rallies.

This time, the result is expected to be bearish since addresses worth between 1,000 and 10,000 BCH have been selling continuously since the beginning of March. Nearly 50,000 Bitcoin Cash worth over $25 million were sold in the last week alone.

However, as the price has continued to rise, the altcoin is now due for a correction.

Read more: Bitcoin Cash (BCH) Price Forecast 2024/2025/2030

In fact, even retail investors will now sell their holdings. This is the ratio of market value to realized value (MVRV). The MVRV ratio measures investors' profits/losses.

BCH’s 30-day MVRV at 10% indicates profit, which could lead to a sell-off. Historically, BCH corrections have occurred when the indicator is between 7% and 17% MVRV, the so-called danger zone.

Therefore, BCH is vulnerable to corrections due to selling, which can occur at any time.

Bitcoin Cash Price Forecast: What to Expect?

If the selling begins, BCH price will likely fail to test the $501 resistance level as support, even if it manages to break through it. A drop to $448 will cause BCH to miss the 50-day exponential moving average (EMA).

A breakdown of this support would result in a decline to $400 or $378, which represents the confluence of the 100-day EMA.

Read more: Will whales abandon BCH and begin a downward cycle?

However, the altcoin could invalidate the bearish thesis if it manages to break out and test $501 as support. BCH would then be open to a rally towards $520.

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, action or decision taken by the reader in accordance with this information is solely the responsibility of it and its affiliates individually, and the site assumes no legal responsibility for such decisions.

تحليلات,العملات الرقمية,بت كوين,بتكوين,بيتكوين,بيتكوين كاش,بيتكوين كاش BCH

Comments

Post a Comment