Larry Fink, co-founder and chairman of asset management giant BlackRock, said he was positively surprised by the response from retail investors to his company's Bitcoin Spot Fund (ETF). Fink expressed his strong belief in the long-term future viability of Bitcoin.

during accident With Fox Business, Fink discussed BlackRock's iShares Bitcoin Trust, saying: "We did not expect, prior to the fund's launch, to see such demand from retail investors. » He added: "I was surprised by the increase in Bitcoin... and we are now working to create a more liquid and transparent market."

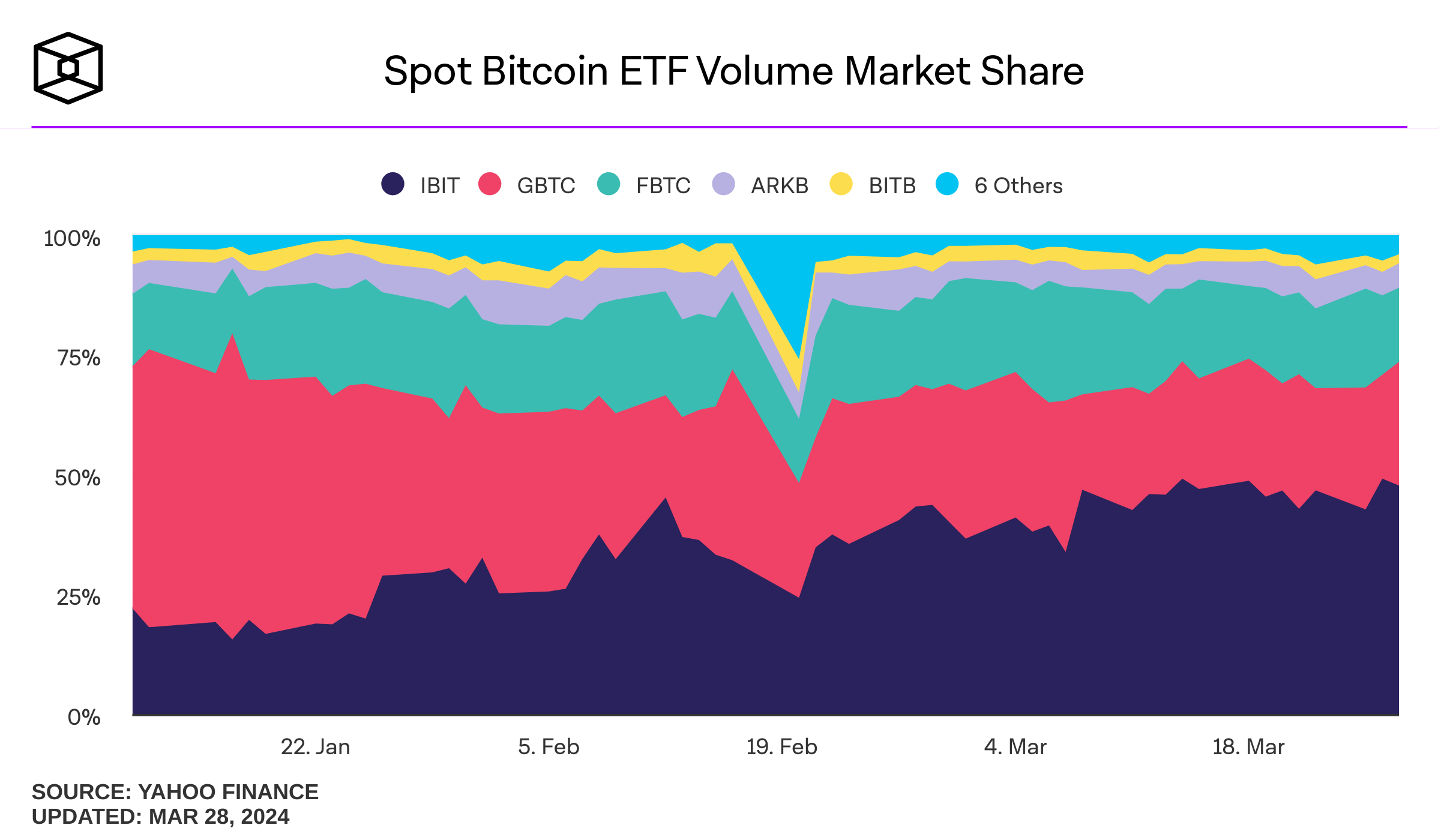

According to Bitcoin ETF tracking data, IBIT has attracted $16 billion in assets under management and accounts for more than 40% of the daily trading volume of spot Bitcoin funds.

Read also: Bitcoin ETF Holdings Surpass 300,000 BTC and Continue to Break Records

In a related context, Fink noted that the IBIT fund launched last January was currently outperforming the Grayscale Bitcoin Fund (GBTC), describing IBIT as an ETF. Fastest growth in history.

Fink hints at launching Ethereum ETFs even though they are classified as 'securities'

Larry Fink did not rule out the possibility of BlackRock launching an Ethereum ETF even though the U.S. Securities and Exchange Commission classifies it as a “security,” meaning it would be subject to broader oversight.

In response to Fox Business' question, Fink said, "I think it's possible." It is worth noting that the Securities and Exchange Commission is investigating the classification of Ethereum as a “security” (or digital currency) and has sent summons to numerous companies as part of its investigation.

The authority's decision has raised concerns about the possibility of offering Ethereum ETFs in the United States. But Fink's confident statements demonstrate notable optimism.

Read also: Is Ethereum Price Falling Due to Pessimism About ETF Approval?

It is worth noting that eight companies, including BlackRock, have applied to issue such funds. Applications have been filed with the Securities and Exchange Commission to launch Ethereum ETFs to the market.

The authority is expected to make its final decision next May. Industry experts believe that all applications will likely be rejected regardless of the outcome of the authorities' investigation into the nature of the Ether currency.

These developments come at a time when BlackRock is so far among 11 institutions issuing Bitcoin spot funds.

Its iShares Bitcoin Trust is the most successful ever. He managed to attract assets worth over $15 billion in just two and a half months.

“I am very optimistic about the long-term viability of Bitcoin,” Fink concluded, telling Fox Business. “We are now creating a market with more liquidity and transparency, and I was surprised by this development in a positive way. I did not expect it before.”

Best Cryptocurrency Trading Platforms

disabled:bg-grey-300 disabled:border-grey-300 disabled:text-grey-100 bic-c-button-secondary mt-4" rel="noopener">

Learn more

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

أخبار,شخصيات بارزة,العملات الرقمية,صناديق ETF

Comments

Post a Comment