The PEPE price is poised for a significant decline as whales stopped accumulating last week, reflecting a decline in investor interest. The change in the SAR from bullish to bearish, as well as the expected potential correction of 40%, shows a new bearish outlook.

Additionally, the appearance of a death cross in the EMA lines indicates that a strong downtrend may take hold soon. Together, these technical indicators indicate a tough time ahead for PEPE stock. With the potential for a significant price decline, making this a critical time for investors to watch closely.

Whales don't crowd PePe

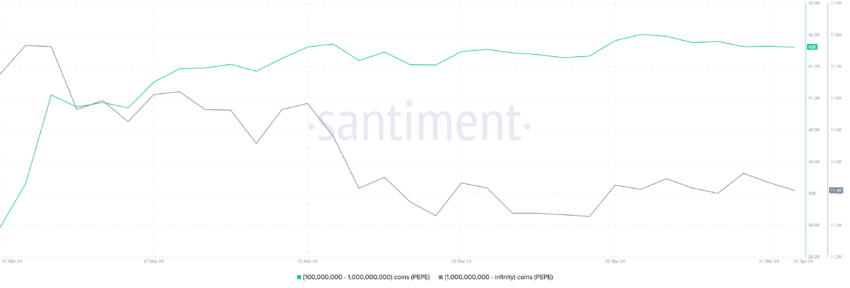

Analysis of whale activity in the PEPE market reveals an interesting scenario that deserves attention. Since March 25, there has been a notable stabilization in the number of addresses holding at least 100 million coins. This indicates a temporary pause in the strong accumulation trends observed previously.

Specifically, the group holding between 100 million and 1 billion pips saw a slight decline, from 42,129 to 42,042 addresses. Likewise, the segment of investors with more than one billion PEPE pesos decreased slightly, from 11,445 to 11,430 addresses.

This change, although slight, is significant when considering whale accumulation as a key metric for gauging market sentiment and potential price movements.

Whale activity is essential for measuring the strengths or weaknesses of the cryptocurrency market. Their diversified exchanges influence the evolution of prices. Their buying or selling tendencies are therefore crucial for price prediction. The pause in PEPE whale purchases since late March indicates a downward trend.

This suggests that large investors lack confidence or are waiting for better conditions. After a period of active buying, this pause signals a slowdown in momentum, which could push the price of PEPE lower.

The PEPE SAR indicator has just changed status

On April 1, PEPE's SAR changed from bullish to bearish, a change that actually caused its price to fall from $0.0000091 to $0.0000070, representing a decline of approximately 23.08%. The SAR (Stop and Reverse) scale is an essential tool for identifying potential market reversals by placing points above or below the price line.

When the points are placed above the price, it indicates a bearish outlook, and conversely, the points below indicate a bullish momentum. For the moment, the PEPE SAR is decidedly bearish. Its points lie above the price line and show a clear descending curve, indicating strong downward momentum.

This bearish situation is particularly worrying given that during the recent SAR decline, PEPE price experienced a major correction, going from $0.0000093 to $0.0000058. This represents a staggering correction of approximately 37.63% in just four days.

The current SAR pattern, which reflects this previous trend, strongly suggests that PEPE may be on the verge of another sharp decline. Investors and traders should pay attention to this bearish signal. The predictive accuracy of the SAR measure has been proven in indicating rapid market declines as well as historical PEPE price movements.

PePe Price Prediction: Is a 29% Correction Imminent?

The EMA (Exponential Moving Average) price lines are approaching a deadly crossover, indicating a bearish outlook. This happens when the 50-day EMA falls below the 200-day EMA, for example. Such a move indicates that short-term prices are falling below long-term averages, indicating a downward trend.

A death cross indicates a potentially significant decline, as it shows decreasing momentum. EMA lines, which focus more on recent prices, help identify trends and their potential changes. This feature of EMA lines is essential for predicting market movements.

Considering the imminent formation of a deadly crossover in the PEPE EMA lines, coupled with the stagnation of whale accumulation and the bearish SAR gauge, there is a compelling case for a sharp correction in the price of the PEPE in the near future.

Read more: Everything you need to know about PEPE currency. Have you missed the get-rich-quick train?

If the expected downtrend materializes, PEPE price could rise from $0.0000070 to $0.00000495, which equates to a correction of approximately 29.29%. The price may decline to test the $0.0000010 support zone if this support level fails to hold.

However, if an uptrend emerges unexpectedly, PEPE could attempt to breach the $0.0000087 and $0.000000095 resistance levels, providing a glimmer of hope for a reversal of the current downtrend.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,تحليل PEPE

Comments

Post a Comment