Following the approval of Ethereum exchange-traded funds (ETFs), lead analyst Michael van de Poppe is bullish on five specific altcoins and expects significant returns.

This historic event sparked interest across the entire Ethereum ecosystem, paving the way For the altcoin season. Here's a look at the altcoins Van de Poppe is looking to buy, each chosen for their potential to generate significant gains.

Read also: Ethereum Price Forecast in 2024

1. Optimism (OP)

Optimism, a layer 2 scaling solution for Ethereum, is the first altcoin on the list. As Ethereum prices rise, platforms improving its efficiency are expected to thrive.

This Layer 2 network uses pooling technology to consolidate transactions, reduce costs and increase speed. Michael van de Poppe highlighted the impressive total value ratio (TVL), which indicates strong growth in the ecosystem. The drop in supply reinforces the optimism of the trader's bullish outlook.

“I think a coin like Optimism could do between, I would say, 300% to 800% in BTC value over the next six months, I think that's very likely and that's probably the first round,” he said. declared Van de Poppe.

2. Arbitration (ARB)

Next is Arbitrum, another Tier 2 solution that closely competes with Optimism. He takes advantage of Groups without knowledge technology that enables faster and more secure transaction processing.

Despite pricing difficulties, the Arbitrum ecosystem displays strong development dynamics. Van de Poppe believes that the scale of TVL and ongoing developments make it a solid investment and that it is poised for a significant rebound.

"If you look at the TVL for this arbitrage, it's almost exactly the same amount as the market cap, so it's very optimistic because the ecosystem is also growing. But once we look at the price action, This is rubbish,” Van. » added de Poppe.

Learn more: Meme Coin Analysis: will you manage to get rich in 2024?

3. WOO Network

Woo Network, a decentralized exchange (DEX) known for its high liquidity and low fees, is another altcoin that Van de Poppe is considering purchasing.

In a sector Decentralized Finance (DeFi), DEXs are gaining momentum due to increasing regulatory pressures on centralized exchanges. The Woo Network's technological advantages and growing user base put it in a good position to grow, especially as transaction volumes on Ethereum continue to increase.

“Once Ethereum starts doing well and volumes really wake up, that's where WOO comes in. There's also revenue generated, which is why I think it's great to have, I think when the whole cycle starts for WOO, it can actually produce what's in between. 500 to 1,500%,” Van de Poppe explained.

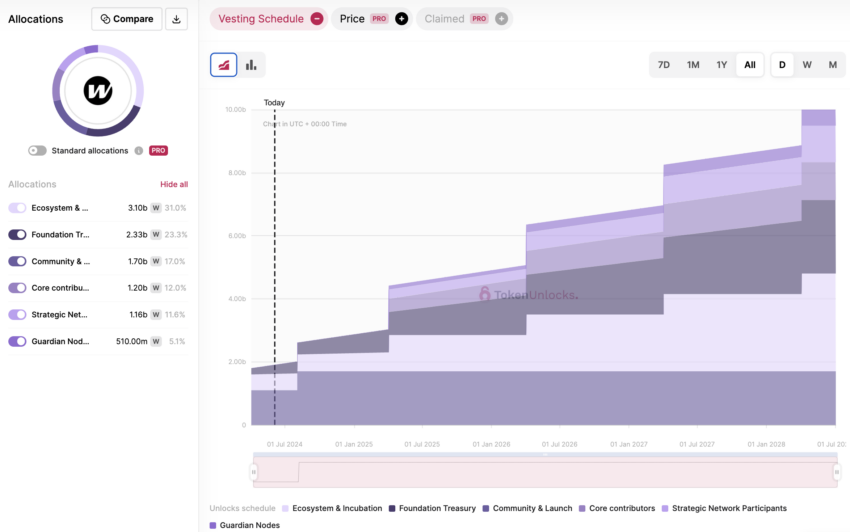

4. Hot hole piece (W)

Wormhole, a bridging protocol for interoperability between blockchains, takes fourth place. As the DeFi landscape expands, seamless asset transfers between different blockchains are crucial.

Its innovative solutions facilitate this cross-chain communication, making it an attractive investment. Although it is relatively new, its potential for widespread adoption and integration into various blockchain ecosystems is high.

"I want to bet on Solana (SOL) Secure Solutions. The only difficult part of Wormhole is the fact that there are still unlocks, but these unlocks will take a while, which is why I think this one will work very well. "Good", Van" added de Poppe.

5. Dogecoin (Doge)

Finally, you stay Dogecoin currency Which Piece of money Well known, it is a favorite. Despite its volatility, the support of the Dogecoin community and recent price action make it a viable play in the short term.

Michael van de Poppe sees it as a high-risk, high-reward asset, especially against the backdrop of the broader crypto market boom.

“Like it or not, you see that all the pieces themselves are doing well. Floki, the meme book, Bonk. All of these pieces are doing well. This is when you want to get into the Dogecoin position. 4x will do the trick. Up to 5x or maybe more,” concluded Van de Poppe.

Learn more: The most important predictions for Bitcoin price in 2024

These altcoins are selected based on their technological strengths, market position and high return potential. However, these investments must be approached with caution, given the volatility inherent in the cryptocurrency market.

Best Cryptocurrency Trading Platforms

Of confidence

Disclaimer

All information published on our website is offered in good faith and for general information purposes only. Therefore, any action, behavior or decision taken by the reader in accordance with this information is solely the responsibility of itself and its affiliates individually, and the site assumes no legal responsibility for such decisions.

الأسواق,العملات الرقمية,العملات المشفرة

Comments

Post a Comment